BCS Markets Review 2025

Highlights of BCS Markets

BCS Markets is a broker suitable for traders of all levels. Narrow spreads and low swaps make it advantageous for active traders. Beginner traders will appreciate the extensive educational materials and support for popular trading platforms such as MetaTrader 4 and 5. High-quality analytical tools help make informed trading decisions.

However, it is worth noting that BCS Markets is regulated offshore, which raises concerns about fund security. The limited number of deposit and withdrawal methods, the small number of available trading products, and the inactivity fee may create inconveniences for traders.

Pros and Cons of BCS Markets

Pros

- Tight spreads.

- Commission-free account funding.

- Accessible trading platforms.

- Inclusion of quality analytics from experts in the service package.

- Educational materials to help novice traders master trading.

Cons

- Offshore regulation.

- Inactivity fee and high swaps.

- Limited number of deposit and withdrawal methods.

- Small number of trading assets.

- Non-24/7 technical support.

BCS Markets reviews

Leave a review of your experience:

BCS Markets Broker Overview

| Foundation Year | 2006 |

|---|---|

| Official Website | https://bcsmarkets.com |

| Regulated in Countries | Saint Vincent and the GrenadinesMore Details |

| Minimum Deposit |

|

| Spread | from 0.2 points |

| Max Leverage | 1:200 |

| Trading Assets |

|

| Trading Platforms |

|

| Email Support |

|

| Hotline Phones |

|

| Social Media |

Important: BCS Markets should not be confused with BCS Forex, although both companies are part of the BCS Financial Group (which also includes the stock broker BCS World of Investments). BCS Forex is one of the Forex brokers licensed by the Central Bank of the Russian Federation and has its trading conditions.

BCS Markets is in the top 10 of the following ratings:

BCS Markets Review Summary

- Part of the large BCS financial group.

- Extensive experience in financial markets.

- Offshore registration and regulation.

All our ratings are based on a carefully developed methodology. We strive to ensure objectivity and independence in evaluating each broker. Continue reading to learn more about BCS Markets.

Reliability and Regulation

| Legal Entity | Regulator |

|---|---|

BCS Markets LLC BCS Markets LLC | SVGFSA SVGFSA |

BCS Markets LLC is registered in Saint Vincent and the Grenadines, which is considered an offshore zone. Offshore regulators typically offer a less stringent regulatory framework compared to jurisdictions such as the United Kingdom (FCA), the United States (CFTC, NFA), Australia (ASIC), or European Union countries.

The SVGFSA does not provide the same level of protection as its counterparts from countries with developed financial markets. This includes the lack of any guarantee of compensation in the event of the broker's bankruptcy.

However, considering that the company is part of the BCS Financial Group, which has been on the market since 1995 and has a good reputation in Russia, it can be assumed that BCS Markets adheres to specific quality standards.

Account Opening

The account opening process at BCS Markets is simple: it requires filling out basic information and confirming registration via email. Verification, although it requires some documents, usually takes a little time. It is also convenient that the personal account area offers a variety of features, including account management, financial operations, and access to educational materials.

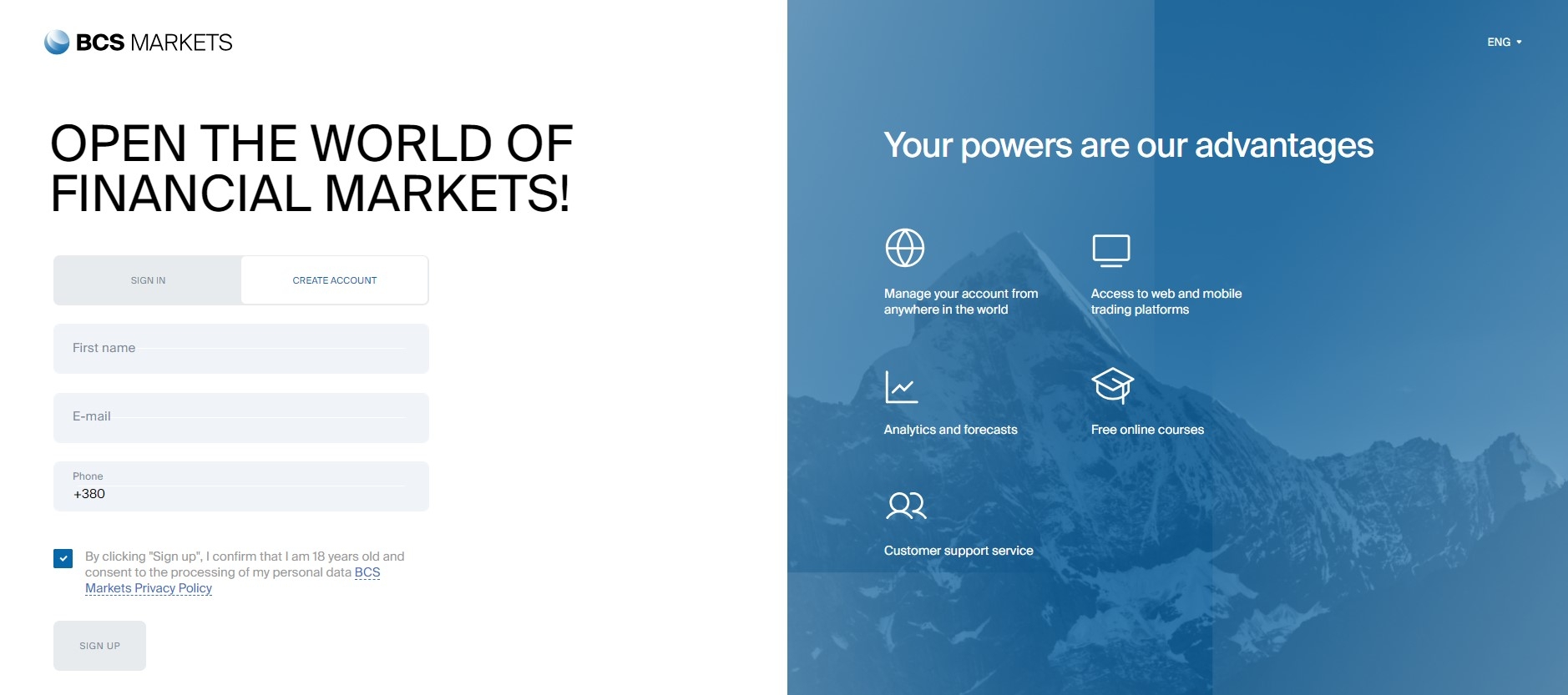

Registration

To open an account at BCS Markets on the official website, click "Join now".

To register, you need to fill out the following information:

- First and last name;

- Mobile number;

- Email address;

To complete the registration, follow the link in the message sent to your email.

Verification

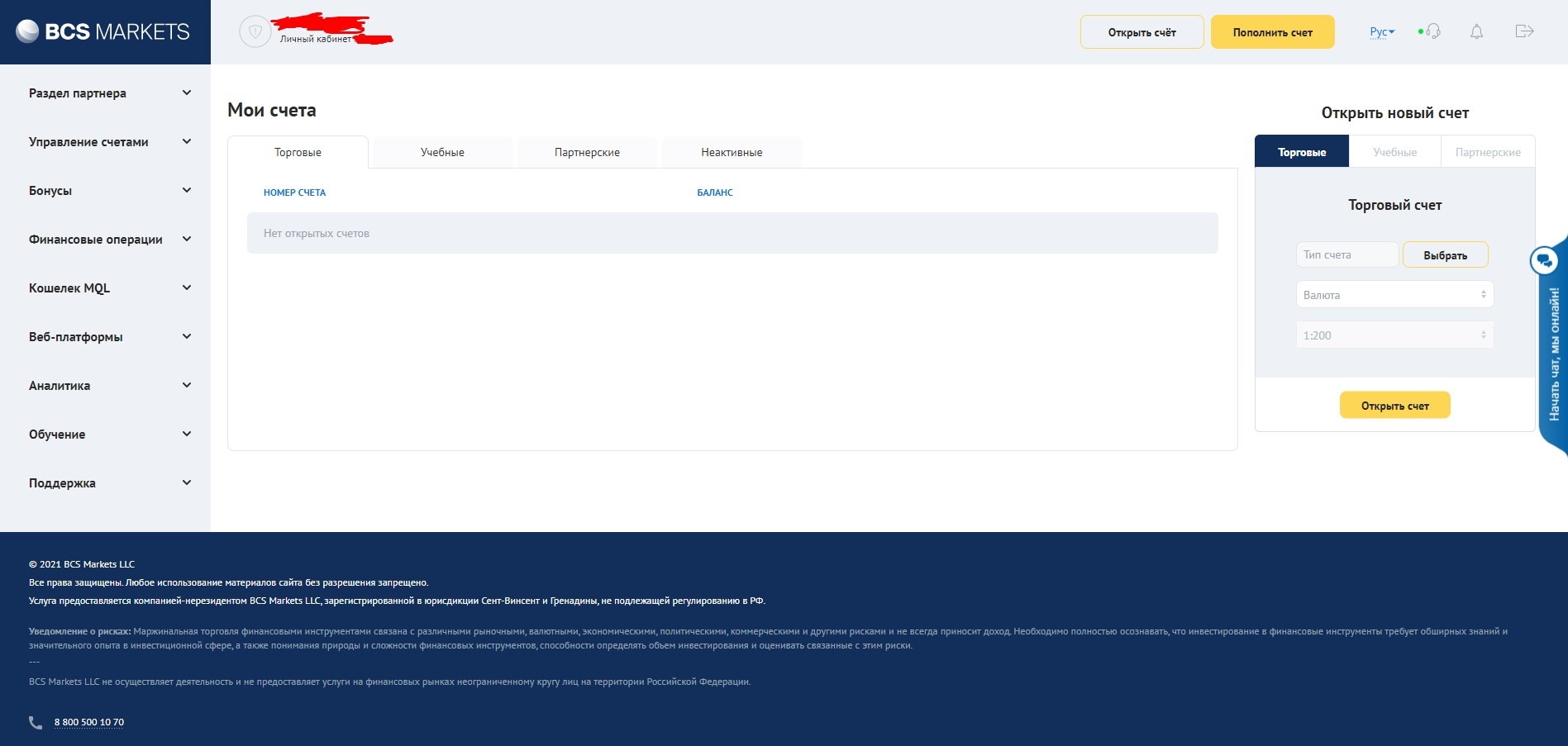

To open a trading account and start the verification process in the personal account area, click "Open account."

At the first step of verification, you need to specify your citizenship and consent to processing personal data.

Next, select the document type to confirm your identity (passport, international passport, or ID card) and upload it. This can also be done from a phone.

Confirm your registered address or place of residence. Upload one of the following documents:

- a scanned copy or photo of the passport page with the registration mark;

- a bank account statement;

- a paid utility bill;

- a paid bill for Internet/cable TV/home telephone service;

- a tax declaration;

- a tax account statement;

- another document issued by a governmental organization.

After verification, you will receive a notification about the result of processing your account opening application. The verification process typically takes 3-5 minutes.

Client Portal

To log in to the client portal, use the address bcsauth.com.

In the BCS Markets client portal, you have access to:

- management of trading accounts;

- financial operations;

- participation in company bonuses and promotions;

- broker training and analytics;

- connection of MQL5 signals;

- web trading platforms;

- company's partner section;

- contacting support service through tickets.

Minimum Deposit

BCS Markets does not impose strict restrictions on the minimum deposit. However, for successful trading, it is essential to consider that the deposit size should be sufficient to cover the minimum margin for the position being opened.

Account Types

BCS Markets offers clients four types of trading accounts, which are sufficient to meet the needs of most traders. However, there are no such account variations as cent accounts, Islamic accounts, and investment accounts, which could expand the choice and offer additional opportunities for specific categories of traders.

Trading Accounts

The broker is ready to offer its clients four accounts to choose from. If you are unsure which to choose, the following characteristics will help you weigh all the decisions and come to the correct conclusion:

| Direct | NDD | Pro | Mobile | |

|---|---|---|---|---|

| Account Currency | USD, EUR, RUB | USD | ||

| Minimum Deposit | 1 $ | |||

| Trading Platforms | MetaTrader 5 | MetaTrader 5MetaTrader 4 | MetaTrader 4 | Brokstock |

| Spread | floatingfrom 0.7 pips~ 0.9 pips | floatingfrom 0.2 pips~ 0.4 pips | fixedfrom 1 pips | floatingfrom 0.7 pips~ 0.9 pips |

| Commission per Trade | per 1 lot3 $ | |||

| Trading Assets | ForexIndicesStocksPrecious MetalsEnergy CarriersSoft Commodities | ForexPrecious MetalsEnergy CarriersSoft Commodities | ForexIndicesStocksPrecious MetalsEnergy CarriersSoft Commodities | |

| Opened Positions | up to 100 | up to 200 | up to 100 | |

| Leverage | 1:1-1:200 | |||

| Margin Call / Stop Out | 100% / 20% | 100% / 50% | 100% / 20% | |

| Order Execution | MM | STP | MM | |

| Demo Account | ||||

| Islamic Account | ||||

Demo Account

BCS Markets has a convenient demo account for beginners, which can be used to understand the system's operation and consider all the nuances.

To open it, you will need to take the following steps:

- Log in to your Account on the BCS Markets website.

- Go to the "Open New Account" tab on the main page and select the "Demo" section.

- Fill in the required fields, specifying the account type, currency, leverage size, and initial balance.

- Click the "Open Account" button.

After completing these steps, an email with a login and password will be sent to the email address provided during registration. These credentials should be used to log in to the MetaTrader trading platform.

Commissions

Trading commissions of BCS Markets are at an average market level, making them quite competitive. However, the inactivity fee may impact the overall rating, especially for investors who prefer long-term strategies or do not trade frequently.

Trading Commissions

BCS Markets' trading commissions include a transaction fee and costs associated with spreads and swaps.

Transaction Fee

The transaction fee on the NDD account is 3 US dollars per 1 lot, which is at an average market level. This ensures transparency and predictability of your trading costs.

Below is the commission per lot for the EURUSD pair at different Forex brokers:

| Broker | IC MarketsRaw Spread | PepperstoneRazor | BCS MarketsNDD | RoboforexECN | FxProRaw+ |

|---|---|---|---|---|---|

| Commission per lot | $3.5 | $3.5 | $3 | $2.16 | $3.5 |

Spreads and Swaps

BCS Markets offers tight spreads and above-average swaps.

| Asset | Average spread | Swap long | Swap short |

|---|---|---|---|

| AUDUSD | 2.2 pips | -3.39 pips | -1.54 pips |

| EURUSD | 0.9 pips | -7.08 pips | 0.64 pips |

| GBPUSD | 1.3 pips | -3.08 pips | -1.54 pips |

| NZDUSD | 2.7 pips | -5.08 pips | -5.46 pips |

| USDCAD | 1.1 pips | -3.99 pips | -4.31 pips |

| USDCHF | 1.1 pips | 0.79 pips | -9.24 pips |

| USDJPY | 1.1 pips | 0.50 pips | -6.16 pips |

Inactivity Fee

If a client's account has assets and no trading operations have been conducted for 6 months, BCS Markets can classify the account as inactive and charge a monthly maintenance fee. The amount of this fee is set in the Contract Specifications. The inactivity fee ceases to be charged when the balance reaches zero. The entire balance is deducted if the account balance is less than the inactivity fee.

Deposit and Withdrawal

BCS Markets provides a sufficient variety of methods for account funding, including bank transfers, payments through the Fast Payment System (FPS), and credit and debit cards, making the process convenient for most clients. The absence of deposit fees is a significant advantage. However, the lack of e-wallets and cryptocurrencies might be a drawback for some users.

Account Funding Methods

For depositing funds, one of the following options can be used:

| Payment System | Currencies | Deposit Fee | Operation Limit |

|---|---|---|---|

0% | — | ||

0% | — | ||

0% | from 10 to 650 USDfrom 10 to 500 EURfrom 500 to 50000 RUB | ||

0% | — | ||

0% | — |

Bank transfer deposits take 2-3 business days, through BCS Online - 1-2 business days, and other methods - instantly.

Withdrawal Methods

As for withdrawing money, there are fewer methods and higher commissions than for depositing funds.

| Payment System | Currencies | Withdrawal Fee | Operation Limit |

|---|---|---|---|

0%+ 35

USD | — | ||

2.5% | from 1050 RUB |

Withdrawals take from 1 to 3 business days.

Markets and Products

BCS Markets offers access to several markets, including currency pairs, stocks, indices, metals, and energy commodities, but the total number of CFDs is small compared to other brokers. Also, the broker's assortment lacks CFDs on cryptocurrencies and soft commodities.

Which markets are available?

The following CFDs are available for trading on BCS Markets:

| Broker | IC Markets | BCS Markets | Pepperstone |

|---|---|---|---|

| Forex | 61 | 37 | 97 |

| Precious Metals | 7 | 3 | 20 |

| Energy Carriers | 5 | 4 | 4 |

| Soft Commodities | 8 | 3 | 16 |

| Indices | 25 | 11 | 26 |

| Stocks | 2175 | 59 | 986 |

| ETF | 38 | — | 108 |

| Bonds | 10 | — | — |

| Cryptocurrency | 21 | — | 30 |

Margin Requirements

The table below shows the maximum leverage values for each asset category. Note that leverage depends on the account type and trading volume (the higher the volume, the lower the leverage).

| Trading Instrument | Max. Leverage for Retail Traders |

|---|---|

| Forex | 1:200 |

| Precious Metals | 1:100 |

| Energy Carriers | 1:10 |

| Indices | 1:50 |

| Stocks | 1:10 |

Trading Platforms

BCS Markets offers traders a wide selection of trading platforms, including the classic MT4 and MT5 and the proprietary BCS Trade mobile app. These platforms are available on various devices, including Android, iOS, and Windows, and provide a full set of necessary features for effective trading.

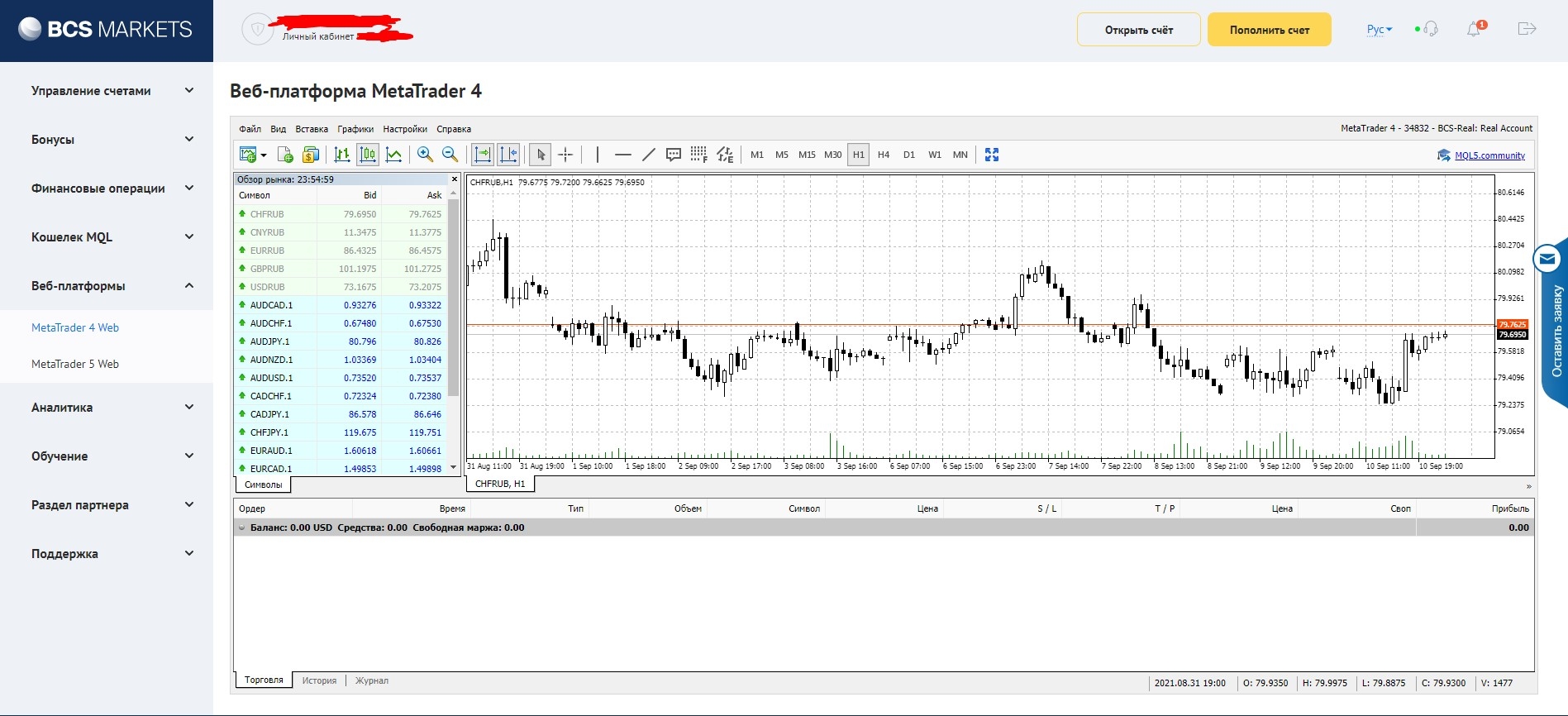

MetaTrader 4 and 5

MT4 and MT5 are already classic trading platforms for Forex. On BCS Markets, the platforms are available on:

- Android;

- iOS;

- Windows.

If you do not wish to download a trading platform onto your device, you can always use the web terminal for MT4 or MT5 in your account.

BCS Trade

BCS Trade is a mobile trading application from BCS Markets. Within the app, you can:

- trade Forex or CFDs;

- monitor the markets;

- compile portfolios of tradable assets;

- keep up with the latest economic news.

You can download the application for free from the official broker's website for both Android and iOS.

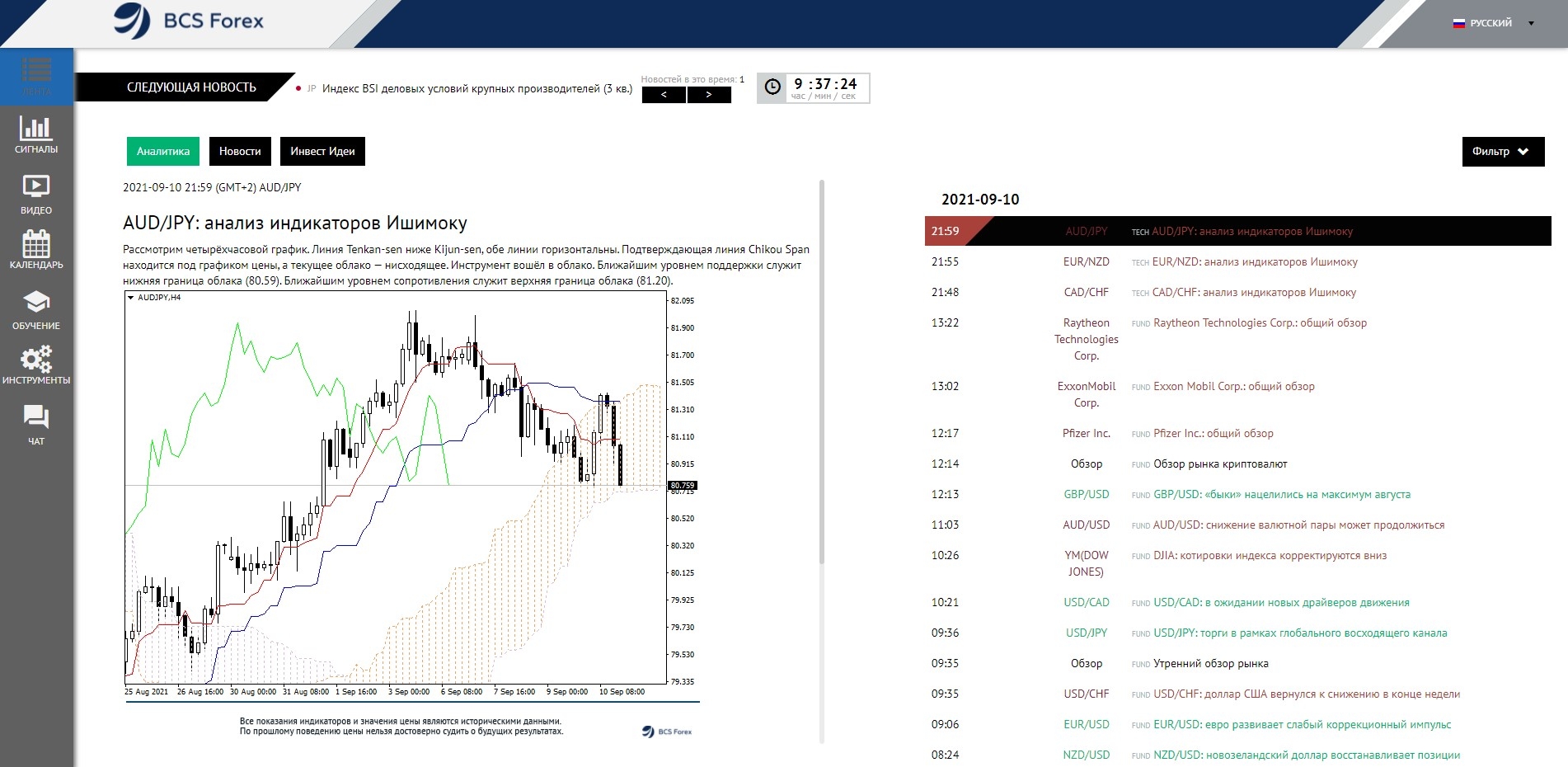

Analytics

In the personal account of a BCS Markets user, there are free analytics from the broker's experts.

The BCS Markets analytical portal includes:

- recommendations and forecasts for any trading instruments based on technical analysis;

- market video reviews;

- automatic trading signals, also based on technical analysis indicators;

- economic calendar;

- various Forex indicators and calculators for levels, correlations, and volatility;

- heat map and currency converter;

- chat with traders.

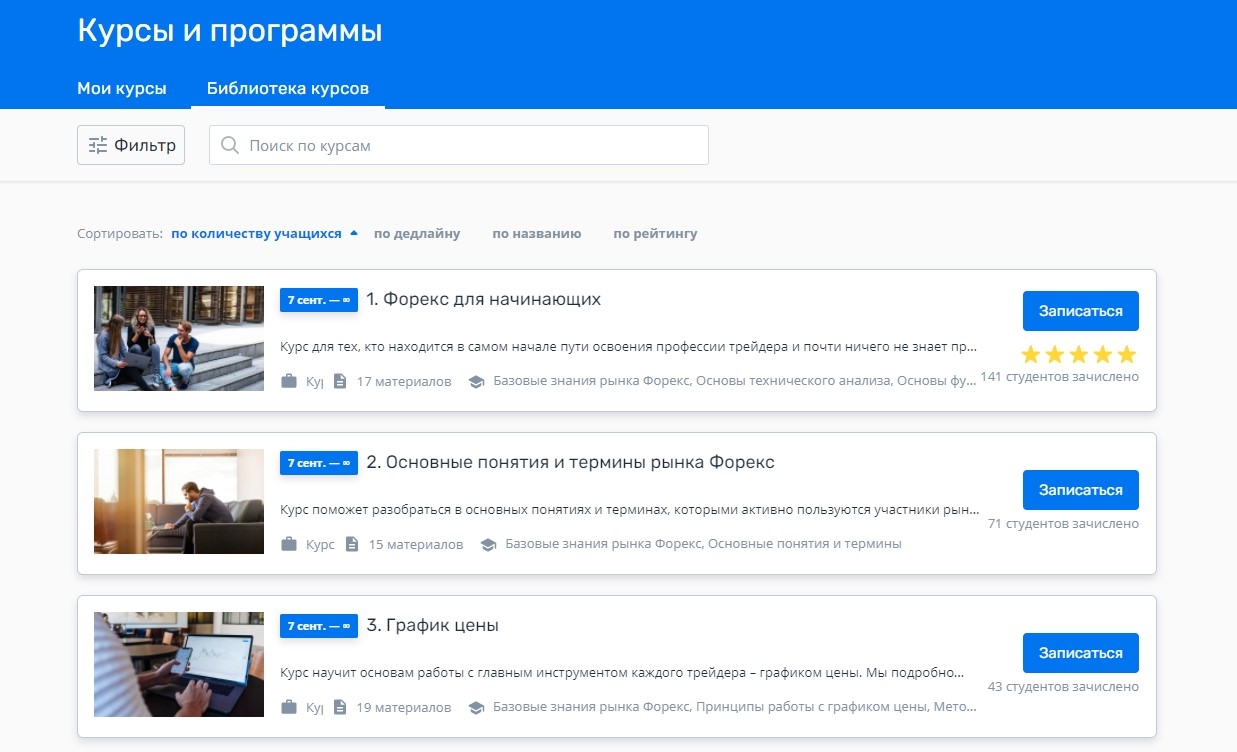

Education

BCS Markets offers various educational materials, including webinars and courses for beginners. This will help new traders understand the basic terms and trading strategies. However, materials for more advanced levels of education are not provided.

The Forex courses will assist you with the following:

- understand the basic terms and concepts in forex;

- master the MetaTrader 4 and MetaTrader 5 terminals;

- learn to read price charts;

- study candlestick and indicator analysis methods;

- grasp technical analysis patterns.

The training is provided by the StudyTrade service and is available in the BCS Markets personal account.

Customer Support

BCS Markets offers several communication channels with support and provides sufficiently prompt and professional assistance. A minor downside - support working hours are not 24/7, which may cause inconvenience for traders from other time zones.

Support Schedule

Support operates from Monday to Friday from 9:00 to 18:00 Moscow time. You can contact them for all the details.

How to contact support?

- Phone: 8 800 500 10 70

- For international calls: +7 499 677 10 70

- Email: support@bcsmarkets.com

- Support service in WhatsApp and Telegram: +7 705 128 19 06, +7 705 463 52 59

Comparison of BCS Markets with Competitors

Looking for alternatives to BCS Markets? Compare key features of BCS Markets against its competitors.

| Broker |  Forex4you Forex4you |  XTB XTB |  BCS Markets BCS Markets |  Dukascopy Europe Dukascopy Europe |  TeleTrade TeleTrade |

|---|---|---|---|---|---|

| Rating | 3.8/5 | 3.7/5 | 3.8/5 | 3.8/5 | 3.6/5 |

| Minimum deposit |

|

|

|

|

|

| Spread | from 0.1 points | from 0.5 points | from 0.2 points | from 0.1 points | from 0 points |

| Trading platforms |

|

|

|

|

|

| Reviews | Forex4you review | XTB review | Dukascopy Europe review | TeleTrade review | |

| Broker comparison | BCS Markets vs Forex4you | BCS Markets vs XTB | BCS Markets vs Dukascopy Europe | BCS Markets vs TeleTrade |

If you want to compare BCS Markets with other forex brokers in more detail, go to the Forex Brokers Comparison page.

Conclusion

BCS Markets is a broker that suits traders of all levels. The broker is a cost-effective solution for active traders thanks to tight spreads and low swaps. It offers beginners extensive educational materials and support for popular trading platforms. The broker also provides high-quality analytical tools for making informed trading decisions.

However, it should be noted that BCS Markets has offshore regulation, which may raise questions about the safety of funds. In addition, the limited number of deposit and withdrawal methods, the small range of available trading products, and the inactivity fee may create certain inconveniences for traders.

This broker is reliable for those ready to work within its specific features and conditions.

FAQ

Is BCS Markets legit?

BCS Markets is regulated offshore, which raises concerns about the security of funds. While it offers a range of trading services, the offshore regulation may not provide the same level of protection as more established regulatory bodies.

Which country is BCS Markets from?

BCS Markets is headquartered in Russia.

Is BCS Markets an ECN broker?

No, BCS Markets does not operate as an ECN broker. It uses a market-making or STP model for order execution.

How does BCS Markets make money?

BCS Markets makes money through spreads, swaps, and commissions on trades. They also charge fees for inactivity and certain types of transactions.

Is BCS Markets good for beginners?

Yes, BCS Markets is suitable for beginners due to its extensive educational materials and support for popular trading platforms like MetaTrader 4 and 5.

Does BCS Markets offer a demo account?

Yes, BCS Markets offers a demo account, allowing traders to practice and familiarize themselves with the platform before committing real funds.

How can I open an account with BCS Markets?

To open an account with BCS Markets, visit their website, complete the registration form, verify your identity, and fund your account.

How can I delete my BCS Markets account?

To delete your BCS Markets account, you will need to contact their customer support team, who will guide you through the account closure process.

What is the minimum deposit for BCS Markets?

The minimum deposit for BCS Markets starts from $1.

What is the maximum leverage on BCS Markets?

The maximum leverage offered by BCS Markets is 1:200.

How do I deposit funds in a BCS Markets account?

To deposit funds into a BCS Markets account, you can use various methods such as bank transfer, credit/debit cards, and select online banking, depending on your region.

How do I withdraw money from BCS Markets?

To withdraw money from BCS Markets, log in to your account, go to the withdrawal section, choose your preferred withdrawal method, and follow the instructions provided.

Does BCS Markets provide VPS?

No, BCS Markets does not provide VPS (Virtual Private Server) services.

Is BCS Markets suitable for scalping?

Yes, BCS Markets is suitable for scalping, as it offers narrow spreads and fast execution speeds.

Is BCS Markets suitable for auto-trading?

Yes, BCS Markets supports auto-trading through popular platforms like MetaTrader 4 and 5, which allow the use of Expert Advisors (EAs).

Is BCS Markets suitable for hedging?

Yes, BCS Markets allows hedging, enabling traders to open multiple positions in different directions on the same asset.

Is BCS Markets suitable for spread betting?

No, BCS Markets does not offer spread betting services.