HF Markets (HFM) UK Review 2024

Highlights of HF Markets UK

HF Markets UK is an online broker regulated by the FCA in the UK.

The broker provides access to a wide range of trading assets, including currency pairs, stocks, indices, and commodities. The account opening process is convenient and fast, and there are various educational materials available, such as webinars and video tutorials, to help traders enhance their skills. Customer support is available in multiple languages, making the broker appealing to traders worldwide.

Pros and Cons of HF Markets UK

Pros

- Wide selection of trading assets.

- A variety of educational materials and analytical reviews.

Cons

- There is no alternative to MetaTrader.

- High swaps and wide spreads.

HF Markets UK Broker Overview

| Foundation Year | 2009 |

|---|---|

| Official Website | https://www.hfmarkets.co.uk |

| Regulated in Countries | Saint Vincent and the Grenadines, South Africa, Seychelles, Cyprus, United Kingdom, United Arab Emirates, KenyaMore Details |

| Minimum Deposit |

|

| Spread | from 0 points |

| Max Leverage | 1:400 |

| Trading Assets |

|

| Trading Platforms |

|

| Email Support |

|

| Hotline Phones | |

| Social Media |

HF Markets is an international Forex and CFD broker established in 2010, offering clients a wide range of financial trading instruments. Known for its transparency, innovative solutions, and commitment to continuous development, the company has proven itself a reliable partner for traders of various experience levels and strategies.

The HFM broker executes trades in the financial market through straight-through processing of transactions, meaning in an automated mode. This ensures immediate order execution and eliminates manual interference in the trading process, which is particularly convenient for traders concerned about deception from intermediary companies.

HF Markets UK Review Summary

- Stringent FCA regulation ensures transparency and integrity.

- Segregated client accounts enhance fund safety.

- Compensation fund provides financial security against broker insolvency.

In our review of HFM broker, we employ a strict and proven methodology designed to ensure an objective, honest, and comprehensive analysis. This includes thoroughly examining the broker's services and features, evaluating educational materials, verifying the effectiveness of customer support, and much more.

This review serves as a guide for current and potential traders seeking detailed information about the HFM broker. We hope our assessments and conclusions will help you make a well-informed decision.

Continue reading to learn more about the HFM broker and the opportunities it can offer you as a trader.

Reliability and Regulation

| Legal Entity | Regulator | Review |

|---|---|---|

HF Markets (SV) Ltd HF Markets (SV) Ltd | SVGFSA SVGFSA | HF Markets review |

HF Markets SA (PTY) Ltd HF Markets SA (PTY) Ltd | FSCA FSCA | HF Markets SA review |

HF Markets (Seychelles) Ltd HF Markets (Seychelles) Ltd | SFSA SFSA | — |

HF Markets Fintech Services Ltd HF Markets Fintech Services Ltd | - | — |

HF Markets (Europe) Ltd HF Markets (Europe) Ltd | CySEC CySEC | HF Markets EU review |

HF Markets (UK) Ltd HF Markets (UK) Ltd | FCA FCA | Current review |

HF Markets (DIFC) Ltd HF Markets (DIFC) Ltd | DFSA DFSA | — |

HFM Investments Ltd HFM Investments Ltd | CMA CMA | — |

Regulation and reliability of a broker play a key role in choosing a partner for trading in the financial markets. In the case of HF Markets, the company boasts a high level of regulation and security, making it an attractive option for investors and traders.

HF Markets is an international broker under several regulators' jurisdiction, which speaks to its reliability and commitment to maintaining high standards.

Regulation in the United Kingdom

The stringent regulatory framework that governs HF Markets in the United Kingdom provides an additional layer of trust and security. Under the watchful eye of the Financial Conduct Authority (FCA), with firm reference number 801701, HF Markets (UK) Ltd adheres to some of the industry's most rigorous financial standards and practices.

Traders partnering with HF Markets in the UK benefit from a robust protection scheme. The FCA's regulations ensure that the broker operates with transparency and integrity, safeguarding the interests of its clients. One of the critical aspects of this regulatory environment is providing a compensation fund. This fund serves as a safety net for traders, offering financial compensation in the unlikely event of the broker's default or insolvency. This level of protection instils confidence among traders, knowing that a solid regulatory framework backs their investments.

Moreover, the FCA's oversight mandates that HF Markets maintain segregated client accounts. This means that traders' funds are kept separate from the company's operating funds, ensuring that client investments are not used for any other purpose. Such measures are crucial in enhancing the safety of client assets and providing an extra layer of security. The combination of the FCA's strict regulatory standards, the compensation fund, and the segregation of client funds collectively fortify the reliability and credibility of HF Markets as a trusted partner in the financial markets.

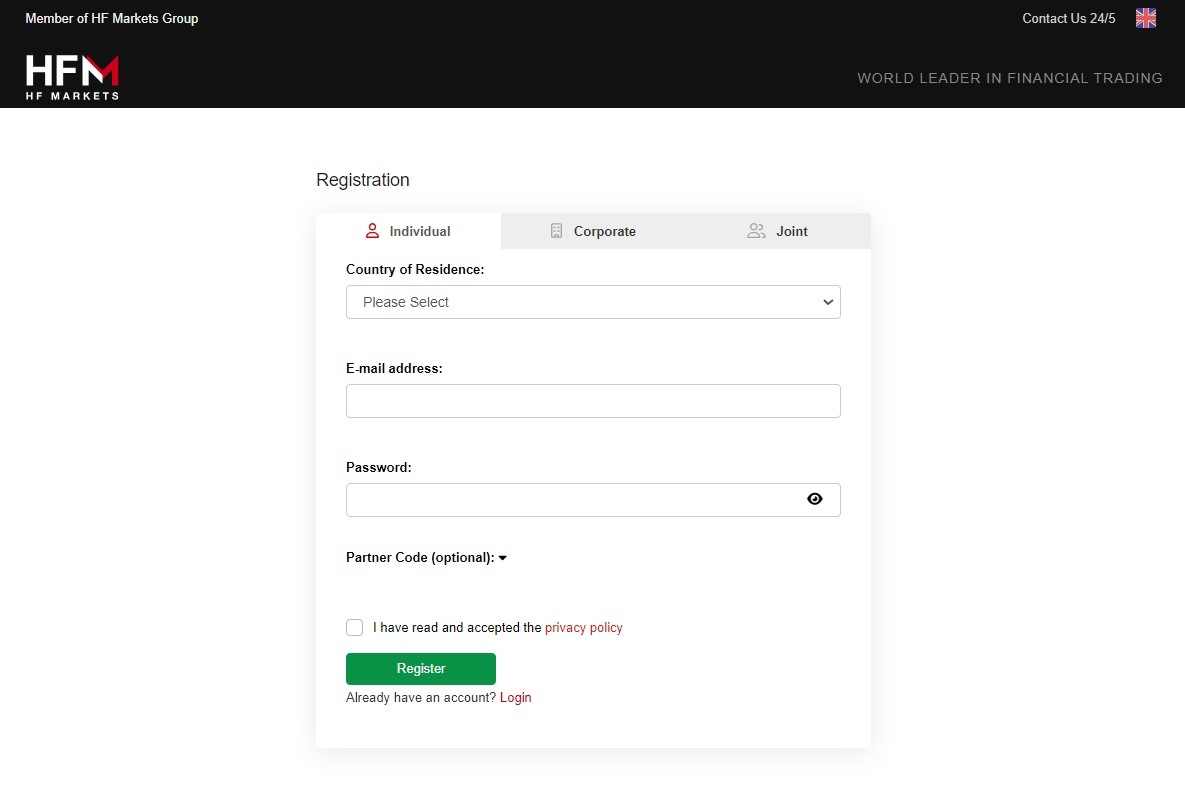

Account Opening

The account opening process with HFM broker is quite easy, fast, and convenient.

Registration

Potential clients should register on the official HFM website for fuller access to information and capabilities.

During registration, you'll be asked to fill out a form. Note the broker's requirement to use only Latin characters in the fields. The broker requests basic information for registration: place of residence, phone number, full name, and date of birth. There's no need to disclose any "secret" information. It's essential to provide accurate personal data to avoid future withdrawal issues.

An activation link for the account is sent immediately. Afterwards, you can use your password to access your account. The email specifies that for full access to services, you must upload scans of your documents.

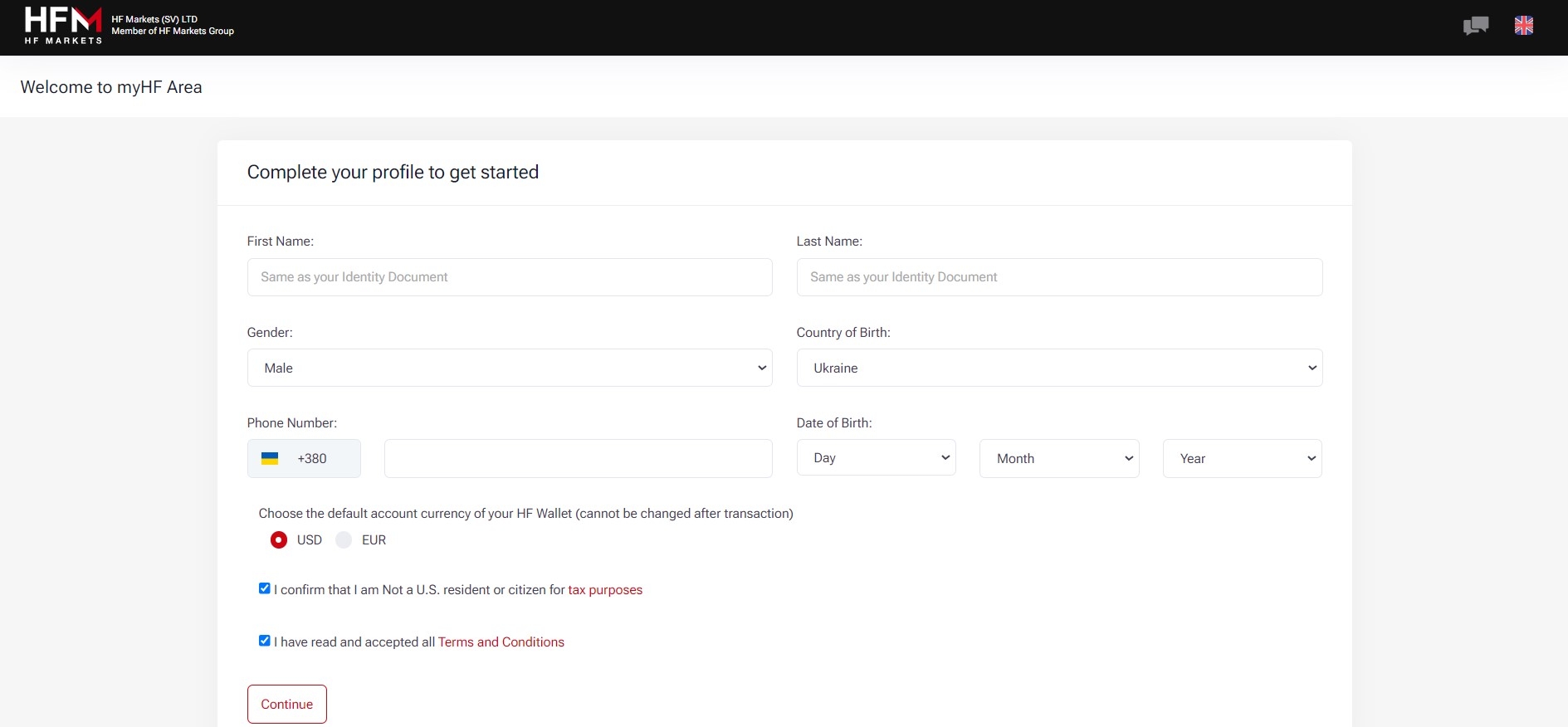

Next, some personal data must be filled in in the registration process.

You also need to complete an economic profile.

Verification

To complete the registration, you must go through verification. While you're not planning to deposit or withdraw funds, this step is not mandatory, but for any transactions with real funds, the broker will request proof of identity and residence.

myHF Area

The HFM client's area, or myHF, is the central place for managing your trading accounts, finances, and private settings. It's designed for ease of use and offers an intuitive interface that allows clients to carry out necessary operations quickly. Here are some key features of the myHF personal account:

Account Management. The personal account allows you to open and close trading accounts, switch between them and manage their settings. You can also view your trading history and analyze your market activity.

Financial Operations. In myHF, you can make deposits and withdrawals using various methods, such as bank transfers, credit/debit cards, electronic wallets, and cryptocurrencies. Your balance and transaction history are available for real-time viewing.

Verification and Security. To comply with regulatory requirements and ensure the security of the client's funds, the personal account includes a verification process for identity and residence. You can upload the relevant documents and monitor the status of their review.

Educational Materials and Analytics. The personal account provides access to various educational materials, webinars, analytical reports, and trading signals to help you improve your trading skills and make more informed market decisions.

Technical Support. If you have any questions or issues, you can contact HF Markets support directly from the personal account. The support team is available 24/5 and ready to assist you with trading-related queries or platform usage.

The HFM client's area provides all the necessary tools and services for convenient and efficient trading in the financial markets. Overall, the myHF personal account stands out for its simplicity and user-friendly interface, making it a convenient tool for traders of all experience levels. With a wide range of functions such as account management, conducting financial operations, access to educational materials, and technical support, HF Markets clients can entirely focus on their trading activities and strategies, receiving maximum support from their broker.

Minimum Deposit

When opening an account with HF Markets, potential investors and traders will be pleased to find that most trading accounts do not have minimum deposit requirements. This makes the broker accessible to a wide range of clients, including those just starting their journey in investing and trading in the financial markets.

However, it should be noted that despite the lack of a minimum deposit for most trading accounts, minimum deposit requirements may still apply to payment systems. Most payment systems set a minimum deposit of $50. When using these systems to fund your trading account, you must deposit at least $50.

Account Types

HFM offers a variety of accounts, providing a broad spectrum of services for different types of clients, from beginners to experienced traders.

Trading Accounts

| Zero | Premium | Premium Pro | |

|---|---|---|---|

| Account Currency | GBP, USD, EUR | ||

| Minimum Deposit | 1 £ | 5 000 £ | |

| Trading Platforms | MetaTrader 4MetaTrader 5WebTrader | ||

| Spread | floatingfrom 0 pipsfor EURUSD~ 0.1 pips | floatingfrom 1.2 pipsfor EURUSD~ 1.5 pips | floatingfrom 0.5 pipsfor EURUSD~ 0.6 pips |

| Commission per Trade | per 1 lot3 $ | ||

| Trading Assets | ForexStocksIndicesBondsETFPrecious MetalsEnergy CarriersSoft Commodities | ||

| Opened Positions | up to 500 | up to 300 | |

| Leverage | 1:1-1:30 | 1:1-1:400 | |

| Margin Call / Stop Out | 80% / 50% | 50% / 20% | |

| Order Execution | STP | ||

| Demo Account | |||

| Islamic Account | |||

| Open AccountRegister | Open AccountRegister | Open AccountRegister | |

HF Markets offers an extensive selection of trading account options. This facilitates trading for clients, from large investors to those who can only invest small amounts.

The company's maximum leverage is 1:30 for retail traders and 1:400 for professional traders.

Scalping trades are allowed at the company. An essential advantage of the company is the ability to trade small volumes, even if a large account is opened. This can reduce risks if a trader is unsure about their forecast.

Demo Account

As with all other companies, the demo account is for educational purposes. It is provided on a complimentary basis, without time limits. There are no strict restrictions on the lot size or deposit – clients can choose the most suitable conditions for learning and practice.

Professional Clients

A Professional Client is typically an experienced, knowledgeable, and sophisticated investor. These clients can make their own investment decisions and understand the risks involved in CFD trading. Consequently, they are granted access to more favourable rates but with lesser regulatory protections than retail clients.

Professional Client Assessment

HF Markets thoroughly assesses a client's expertise, experience, and knowledge. This ensures that those opting for Professional Client status can make informed investment decisions and fully understand the risks associated with CFD trading.

Criteria to Qualify as a Professional Client

| Criteria | Description |

|---|---|

| Trading Experience | Minimum of 40 trades of Significant Size in the last four quarters. |

| Investment Portfolio | A financial instrument portfolio exceeding €500,000. |

| Professional Experience | At least one year in a professional financial sector position requiring knowledge of CFD trading. |

Clients must meet at least two criteria above to be eligible for Professional Client status. For detailed information, clients are advised to refer to HF Markets' Client Categorization Policy.

Important Terms and Conditions for Professional Clients

- Maximum Leverage Limits: Up to 400:1, varying by instrument.

- Margin Close-Out Rule: 20% of the required margin.

- Client Fund Segregation: Ensured for client security.

- Negative Balance Protection: Provided for clients.

- Access to Financial Ombudsman Service: Limited to individual consumers and small companies meeting specific criteria.

- Eligibility for Financial Services Compensation Services: Generally limited to individual consumers and sole trader firms.

Note: Medium and large institutions and regulated financial/credit services may not be eligible for some protections.

Swap-Free Account

HFM respects and listens to the needs of its clients, including those who follow Sharia principles. In its quest to be a universal broker, HFM offers a swap-free trading option.

The Islamic account allows trade without paying or receiving swaps (interest rates), which complies with Sharia principles prohibiting riba or interest. Some instruments may incur costs for carrying over a position if extended for several days, but these costs are typically minimal and insignificant.

Swap-free trading conditions on the Islamic account are available for those who follow Sharia principles and other clients on certain trading accounts and specific instruments. These instruments include AUDNZD, AUDUSD, EURCHF, EURUSD, GBPJPY, GBPUSD, NZDUSD, USDCAD, USDCHF, USDJPY, USOIL, and others.

Nevertheless, HFM strongly recommends its clients trade predominantly within the day and keep overnight positions to a minimum. The company actively monitors the trading history for the mentioned instruments to ensure proper use of swap-free conditions. It reserves the right to revoke the swap-free status at its discretion.

VPS

HF Markets offers three tiers of VPS packages – Bronze, Silver, and Gold. Each package has specific system features, and traders can choose a plan based on their requirements. These VPS packages can be obtained for free, subject to meeting certain deposit and trading conditions. Alternatively, they are available through a paid subscription, with varying prices depending on the selected package.

| Package | Monthly Price | Free Option Criteria | System Features |

|---|---|---|---|

| Bronze VPS | $25 | Specific deposit and trading requirements | 1 vCPU, 2,560 MB RAM, 30 GB SSD Storage |

| Silver VPS | $50 | Specific deposit and trading requirements | 2 vCPU, 4,096 MB RAM, 50 GB SSD Storage |

| Gold VPS | $80 | Specific deposit and trading requirements | 4 vCPU, 6,656 MB RAM, 75 GB SSD Storage |

Signing up for the VPS service is straightforward. Traders can select from the available packages and login to their myHF account to activate the service. It's important to note that each package has terms and conditions that applicants should review before opting for the service.

Commissions

HF Markets' trading commissions are pretty comparable to the market average. However, high swaps can deter long-term trading, and the inactivity fee, while fair, can be quite costly for those who do not trade regularly.

Trading Fees

On the Zero account, the main trading charge is a commission per trade. For other accounts, the costs are spreads and swaps.

Per Trade Commission

HF Markets charges a transaction commission on the Zero account of $3 per lot, which aligns with the market average, making the conditions quite competitive for active traders.

Here's a comparison of the commission per lot for the EURUSD pair among different Forex brokers:

| Broker | Pepperstone UKRazor | FxPro UKcTrader | HF Markets UKZero | FXOpenECN | Admirals UKZero.MT5 |

|---|---|---|---|---|---|

| Commission per lot | $3.5 | $3.78 | $3 | $3.5 | $3 |

Spreads and Swaps

The spreads offered by HF Markets are above the average market range. Swaps at HF Markets are also pretty high, which makes the broker less advantageous for long-term trading strategies.

A table shows the average spread and swaps for major currency pairs on HFM's Premium account.

| Asset | Average spread | Swap long | Swap short |

|---|---|---|---|

| AUDUSD | 2.0 pips | -3.60 pips | 0.00 pips |

| EURUSD | 1.6 pips | -8.00 pips | 0.00 pips |

| GBPUSD | 2.2 pips | -3.10 pips | -2.80 pips |

| NZDUSD | 2.4 pips | -1.50 pips | -2.50 pips |

| USDCAD | 2.6 pips | -1.30 pips | -5.30 pips |

| USDCHF | 2.2 pips | 0.00 pips | -12.50 pips |

| USDJPY | 1.9 pips | 0.00 pips | -28.10 pips |

Inactivity Fee

HF Markets employs an inactivity fee system that kicks in after 6 months of account inactivity.

For inactivity from 6 months to 1 year, a monthly charge of $5 (or the equivalent amount in the account's base currency) is levied until the account balance reaches zero.

If the account remains inactive for 1-2 years, the monthly fee increases to $10. For inactivity of 2-3 years, the charge is $20 per month.

If the account remains inactive for over 3 years, the monthly fee will be the commission for the previous year plus $10 for each additional year until the account balance is zero.

Deposit and Withdrawal

Deposit and withdrawal processes are crucial aspects of interaction with a broker, and HF Markets offers its clients various methods to ensure convenience and speed of transactions. Let's examine the main options for depositing and withdrawing funds from HF Markets.

Deposit Methods

| Payment System | Currencies | Deposit Fee | Operation Limit |

|---|---|---|---|

0% | from 50 to 10000 USD | ||

0% | from 50 to 5000 USD | ||

0% | from 250 USD | ||

0% | from 50 to 10000 USD | ||

0% | from 50 to 10000 USD |

It's important to note that HF Markets does not charge a commission for internal transfers between accounts of the same client, which can be convenient for managing various trading accounts.

Withdrawal Methods

| Payment System | Currencies | Withdrawal Fee | Operation Limit |

|---|---|---|---|

0% limitscommission limits | from 5 USD | ||

0% | from 5 USD | ||

0% | from 100 USD | ||

0% limitscommission limits | from 5 USD | ||

0% limitscommission limits | from 5 USD |

Before withdrawing, ensure your account has been verified, and all your documents are approved. This is necessary to comply with the regulators' requirements and ensure the security of client funds.

The withdrawal times from HF Markets can vary depending on the chosen method. The broker processes a withdrawal request within a working day.

Markets and Products

HF Markets offers its clients a wide selection of trading assets, allowing for portfolio diversification and finding suitable instruments for individual trading strategies.

Available Markets

Here are the main categories of trading assets available at HF Markets:

| Broker | Pepperstone UK | HF Markets UK | FxPro UK |

|---|---|---|---|

| Forex | 97 | 53 | 69 |

| Precious Metals | 20 | 6 | 13 |

| Energy Carriers | 4 | 2 | 6 |

| Soft Commodities | 16 | 5 | 7 |

| Indices | 26 | 11 | 29 |

| Stocks | 986 | 95 | 1971 |

| ETF | 108 | 33 | — |

| Bonds | — | 3 | — |

HF Markets is committed to offering its clients a variety of trading instruments to meet the needs of traders with different levels of experience and interests. The broad range of assets allows investors to optimize their investment portfolios, considering their risk appetite and trading preferences.

However, the smaller number of stocks compared to some competitors may be an essential consideration for some traders.

Margin Requirements

Leverage may differ for different types of instruments.

| Trading Instrument | Max. Leverage for Retail Traders | Max. Leverage for Pro Traders |

|---|---|---|

| Forex | 1:30 | 1:400 |

| Precious Metals | 1:20 | 1:100 |

| Energy Carriers | 1:10 | 1:10 |

| Soft Commodities | 1:10 | 1:10 |

| Indices | 1:20 | 1:20 |

| Stocks | 1:5 | 1:5 |

| ETF | 1:5 | 1:5 |

| Bonds | 1:5 | 1:5 |

Trading Platforms

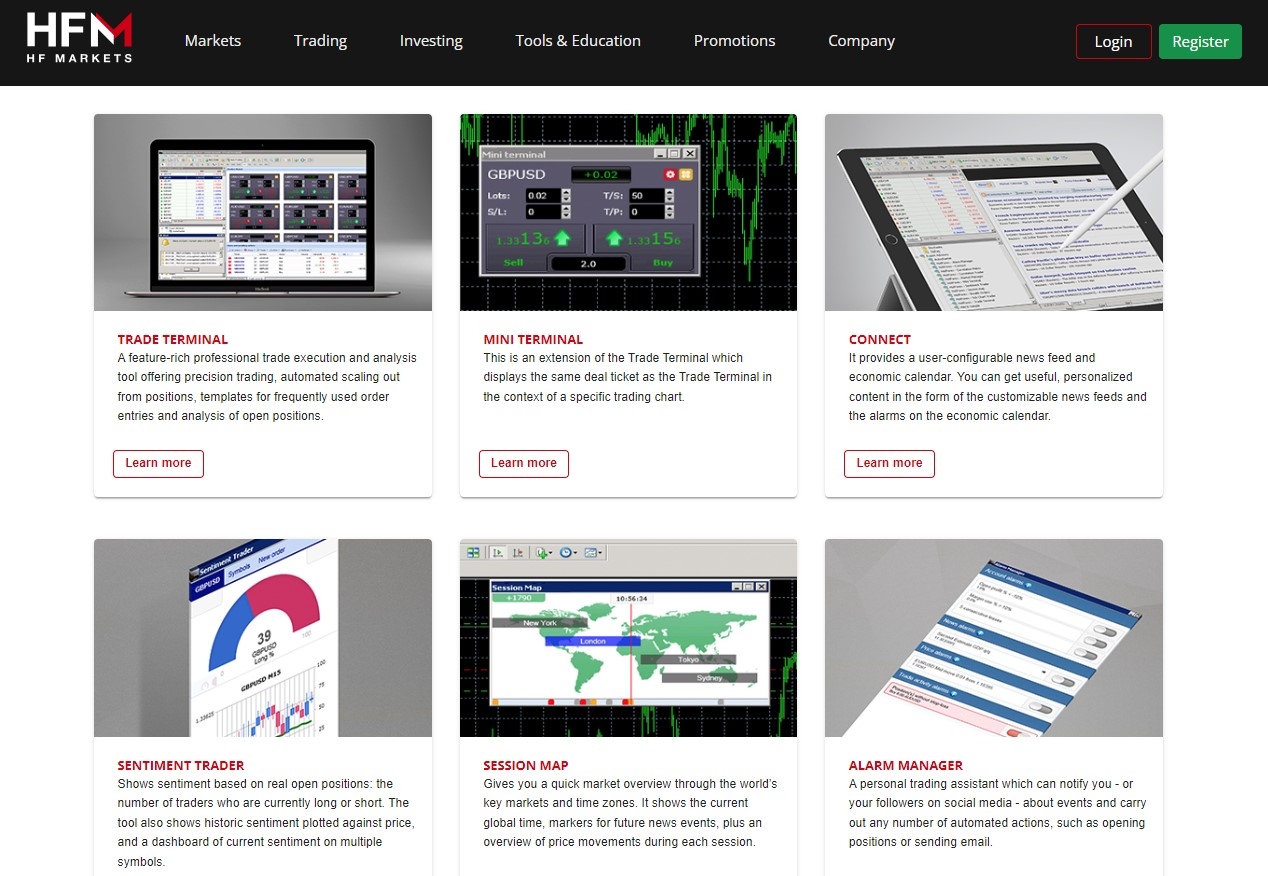

While HFM offers a wide selection of functional and user-friendly platforms, some traders may be looking for more specialized or innovative platforms that some competitors offer.

MetaTrader 4 and 5

HF Markets provides access to two leading trading platforms that are well-known and popular among traders:

MetaTrader 4 (MT4): MT4 is one of the most recognized and widely used trading platforms in the Forex market. It offers an intuitive interface, flexible charting options, a variety of technical indicators and scripts, and the use of trading robots known as Expert Advisors (EAs). MT4 is available for Windows, macOS, Android, and iOS, allowing traders to manage their accounts and monitor the market from any device.

MetaTrader 5 (MT5): MT5 is the newer version of the popular trading platform, offering enhanced features and capabilities. These include advanced tools for technical analysis, support for more trading instruments, built-in economic news and a calendar, and improved optimization for automated trading. MT5 is available on multiple platforms, including Windows, macOS, Android, and iOS.

Both platforms allow traders to customize their workspaces, utilize numerous indicators and graphical objects, conduct multiple trading operations simultaneously, and monitor their account statuses in real time. Additionally, HF Markets offers access to the MetaTrader Marketplace, where traders can find and install additional indicators, advisors, scripts, and trading strategies developed by third-party developers.

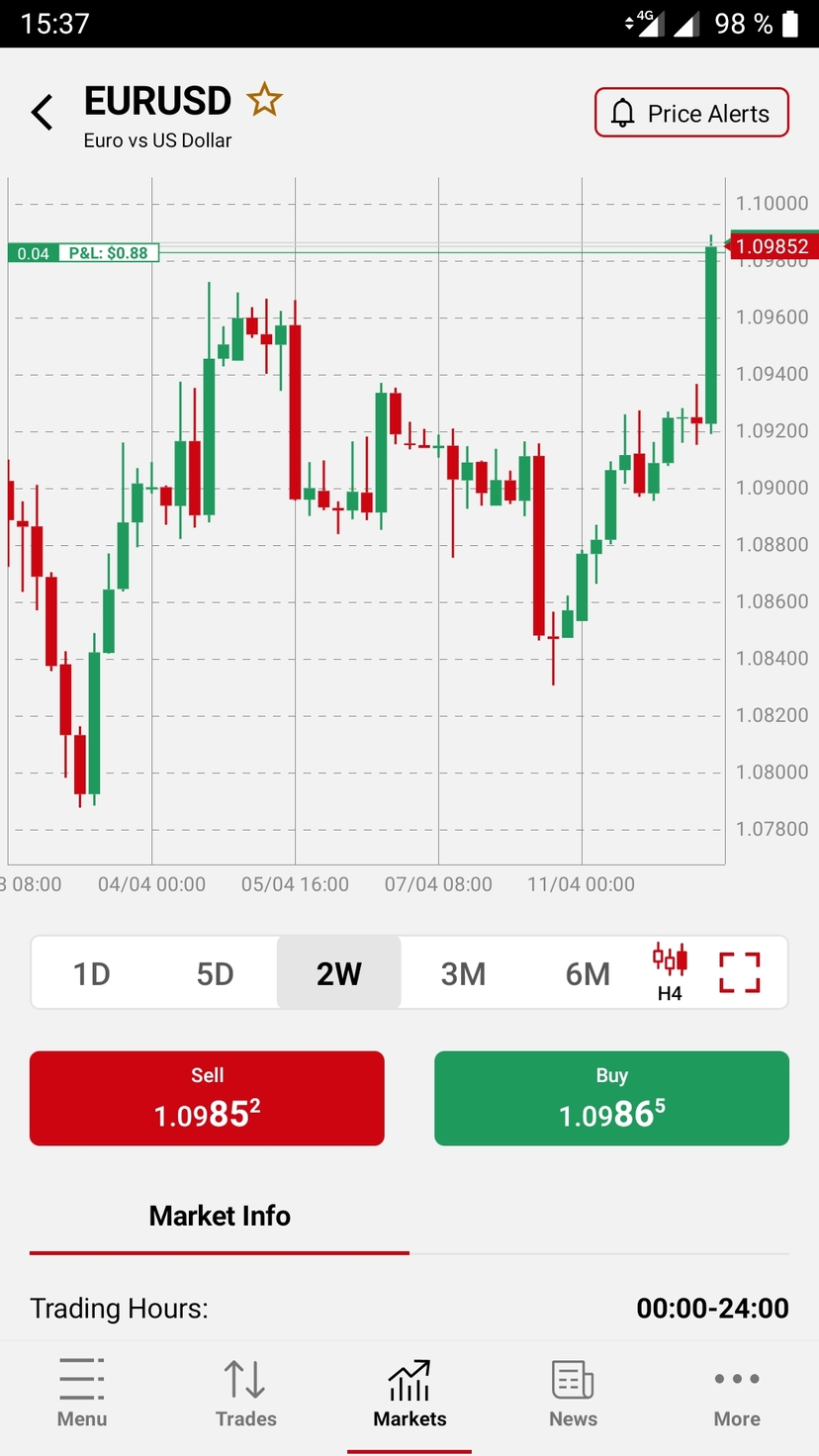

HFM Mobile Application

The broker also has a mobile application for Android and iOS, which allows clients to manage their trading accounts, read news, register for webinars, and even trade on the go. This adds to the convenience for traders who prefer to have access to their trading activities from their smartphones or tablets.

Analytics

HF Markets offers high-quality analytical services and tools that assist traders in successful trading and making informed decisions. The broker's clients can access premium trading tools, practical analysis and automation programs, regularly updated news, and expert reviews.

Analytical Tools

A wide array of tools are available at HF Markets to enhance trading efficiency. These include Premium Trader Tools for MT4/5, which offer extensive capabilities for analysis and decision-making, the Autochartist program for automatic market scanning and identification of potential trading opportunities, and tools for analyzing trading volumes and market sentiment. Additionally, traders can access practical trading calculators and an up-to-date economic calendar.

News and Expert Analysis

The broker actively updates its information segment, providing current market news and expert analytical reviews. Clients can keep track of market developments, receive forecasts on the movement of key currency pairs, and stay informed about global economic events. This enables traders to react to market changes and make well-considered trading decisions promptly.

HF Markets leverages these analytical capabilities to provide traders with the resources they need to understand the market, plan their strategies, and execute trades more effectively, potentially leading to better trading outcomes.

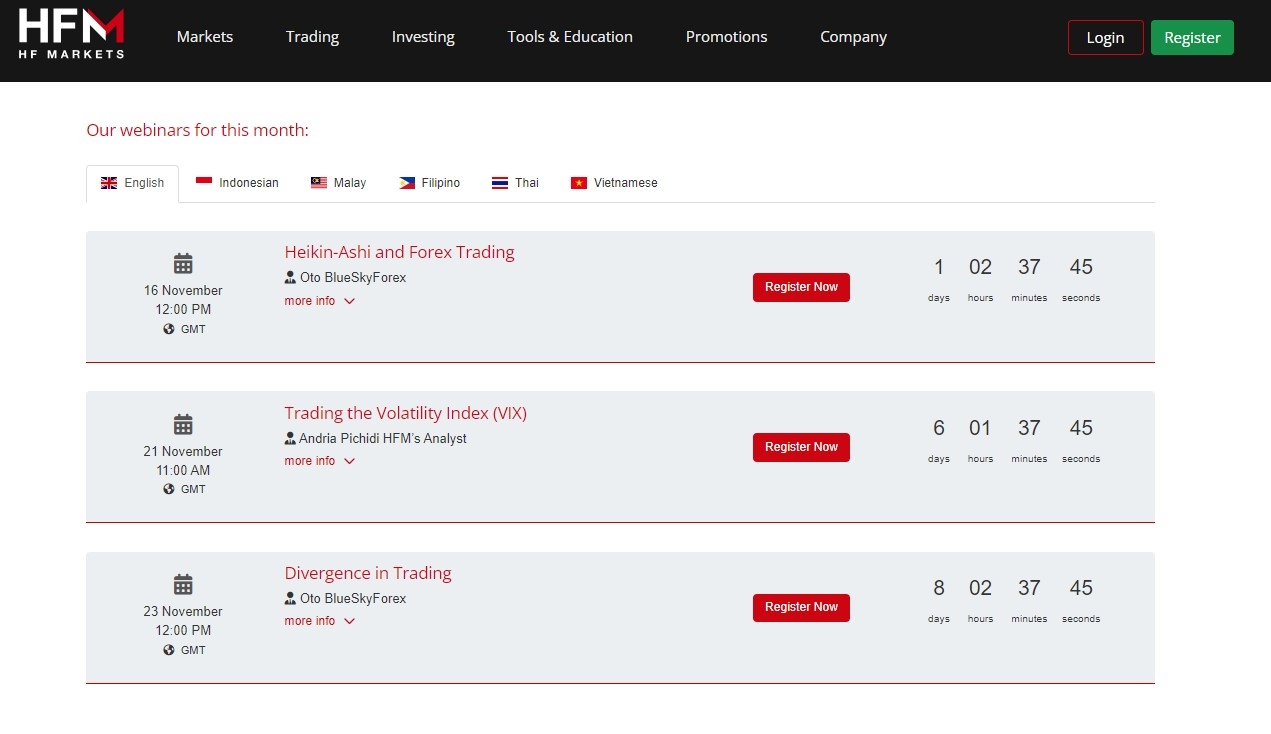

Education

HF Markets is dedicated to creating an optimal educational environment for traders at all levels. Their educational resources cover everything from the basics of Forex and CFDs to complex trading strategies and the psychology of trading.

Forex Trading Webinars. From real-time analysis to scalping strategies, HF Markets' webinars cover all aspects of trading. Spots can be reserved for free, providing an opportunity to learn from experts.

Educational and Tutorial Videos. Over 20 videos cover everything from basic trading principles to analysis and psychology, helping you enhance your skills.

HFM’s E-Course on Forex Trading. This step-by-step course explains Forex principles, helping traders understand complex concepts and strategies.

Daily Market Analysis. HFM experts provide timely and accurate market updates, helping you stay on top of the latest trends.

Global Economic Reports. Receive in-depth reports on economic activity in various countries to better understand global trends.

Gold Trading Guide. Learn about the reliability of gold as an investment and critical factors that influence gold trading.

HF Markets' educational resources are ideal for studying and refining trading skills, allowing you to build confident and well-thought-out trading strategies.

Customer Support

HFM's technical support offers several communication channels, including email, telephone, and online chat, ensuring accessibility and convenience for clients. The staff is responsive and professional, as evidenced by numerous client testimonials. However, the lack of instant messaging options for quick communication and the absence of national phone lines may reduce accessibility for some users.

Support Working Hours

The technical support of HFM operates 24/5.

How to Contact Support?

You can reach them via:

- Email: support@hfmarkets.co.uk

- Phone: +44-203 519 98 98 or 0800 920 2432 (Toll-Free)

- Online chat on their website.

Conclusion

HF Markets UK is a reliable and appealing Forex broker, offering a wide selection of trading assets, a variety of account types, and access to the popular trading platforms MetaTrader 4 and MetaTrader 5. Thanks to its industry experience and regulatory compliance, the company has become a trusted partner for British traders of all levels of expertise.

HF Markets is recommended for those seeking a trustworthy and vetted broker with favorable trading conditions and customer support.

FAQ

Is HF Markets UK legit?

Yes, HF Markets UK is a legitimate broker regulated by the FCA in the UK.

Which country is HF Markets UK from?

HF Markets UK is headquartered in the United Kingdom, specifically in London.

Is HF Markets UK an ECN broker?

No, HF Markets UK is an STP (Straight Through Processing) broker.

How does HF Markets UK make money?

HF Markets UK makes money through spreads, commissions on trades, and various other fees such as swap fees on overnight positions.

Is HF Markets UK good for beginners?

Yes, HF Markets UK is suitable for beginners due to its user-friendly platform, extensive educational resources, and responsive customer support.

Does HF Markets UK offer a demo account?

Yes, HF Markets UK offers a demo account, allowing traders to practice and familiarize themselves with the platform without risking real money.

How can I open an account with HF Markets UK?

You can open an account with HF Markets UK by visiting their website, filling out the registration form, submitting the required documents for verification, and funding your account.

How can I delete my HF Markets UK account?

To delete your HF Markets UK account, you need to contact their customer support team, which will guide you through the process.

What is the minimum deposit for HF Markets UK?

There are no specific minimum deposit requirements for HF Markets UK.

What is the maximum leverage on HF Markets UK?

The maximum leverage offered by HF Markets UK is 1:30 for retail traders and 1:400 for pro traders.

How do I deposit funds in an HF Markets UK account?

You can deposit funds into your HF Markets UK account using various methods such as bank transfer, credit/debit cards, and e-wallets like Skrill and Netelle.

How do I withdraw money from HF Markets UK?

You can withdraw money from HF Markets UK by logging into your account, navigating to the withdrawal section, and selecting your preferred withdrawal method.

Does HF Markets UK provide VPS?

Yes, HF Markets UK provides a Virtual Private Server (VPS) service, which is beneficial for traders who use automated trading systems or require a stable trading environment.

Is HF Markets UK suitable for scalping?

Yes, HF Markets UK is suitable for scalping, and they allow this trading strategy on their platforms.

Is HF Markets UK suitable for auto-trading?

Yes, HF Markets UK supports auto-trading through platforms like MetaTrader 4 and MetaTrader 5, which are compatible with various automated trading tools.

Is HF Markets UK suitable for hedging?

Yes, HF Markets UK allows hedging, enabling traders to open multiple positions on the same instrument in opposite directions.

Is HF Markets UK suitable for spread betting?

No, HF Markets UK does not offer spread betting.