Axi Review 2024

Highlights of Axi

Axi is a reliable and secure Forex broker, regulated by authoritative bodies.

Axi is ideally suited for beginners and intermediate traders seeking simple and intuitive trading solutions, as well as those looking to enhance their skills through educational materials. Experienced traders who prefer a variety of platforms may find Axi less suitable.

Pros and Cons of Axi

Pros

- Axi is a licensed and regulated broker.

- An extensive set of educational resources.

- Convenient and useful trading tools.

- Variety of deposit and withdrawal methods.

Cons

- Limited choice of trading platforms.

- Demo account with limited duration.

- Inactivity fee.

Axi reviews

Leave a review of your experience:

Axi Broker Overview

| Foundation Year | 2006 |

|---|---|

| Official Website | https://www.axi.com |

| Regulated in Countries | Saint Vincent and the Grenadines, Australia, United Arab Emirates, United KingdomMore Details |

| Minimum Deposit |

|

| Spread | from 0 points |

| Max Leverage | 1:500 |

| Trading Assets |

|

| Trading Platforms |

|

| Email Support |

|

| Hotline Phones | |

| Social Media |

Axi was founded in 2007 and has successfully operated in the financial services market for many years. By providing services for trading on the international Forex market and CFD (Contracts for Difference), Axi has become a recognized leader in this field.

Thanks to its experience and constant pursuit of innovation, the company offers optimal conditions for various trading categories and a wide range of trading instruments. Axi also actively cares for its clients, providing quality technical support and educational materials that allow traders to enhance their professional level and succeed in the Forex market.

Axi Review Summary

- Regulated by leading authorities (FCA, ASIC, DFSA).

- Segregated bank accounts for fund protection.

- Strict compliance with international norms and regulations.

How do we evaluate Axi broker? Our assessment is based on a thorough analysis of various aspects of the broker's operation, including trading conditions, customer service quality, platforms, and more. We apply a clear and transparent methodology to provide you with the most accurate and objective picture. You can read our detailed broker evaluation methodology to learn how we approach broker evaluation.

Your trust in us is essential, and we strive to provide you with all the necessary information to make informed trading decisions. Continue reading the review to learn about Axi and determine if it suits your needs and trading strategies.

Reliability and Regulation

| Legal Entity | Regulator | Review |

|---|---|---|

AxiTrader Limited (AxiTrader) AxiTrader Limited (AxiTrader) | SVGFSA SVGFSA | Current review |

AxiCorp Financial Services Pty Ltd (AFSPL) AxiCorp Financial Services Pty Ltd (AFSPL) | ASIC ASIC NZ FMA NZ FMA | Axi AU review |

AxiCorp Financial Services Pty Ltd (DIFC Branch) AxiCorp Financial Services Pty Ltd (DIFC Branch) | DFSA DFSA | — |

Axi Financial Services (UK) Axi Financial Services (UK) | FCA FCA | Axi UK review |

The reliability and regulation of a broker are among the key factors when choosing a trading partner in financial markets. In the case of Axi, it can be noted that it provides a high level of reliability and complies with many international standards.

Firstly, Axi is regulated by several leading financial authorities, demonstrating its activities' transparency and legality. The company is registered and controlled by Forex regulators such as the FCA (UK), ASIC (Australia), and DFSA (UAE). Having licenses from these bodies means that Axi strictly adheres to international rules and norms, making it a reliable partner for traders.

Secondly, Axi takes all necessary measures to ensure the security of client funds. By regulator requirements, client funds are held in segregated bank accounts, which protects them in case of financial problems at the broker.

Thus, considering the strict regulations and measures to ensure the security of client funds, it can be asserted that Axi is a reliable and proven broker with whom traders can cooperate without fear for their investments.

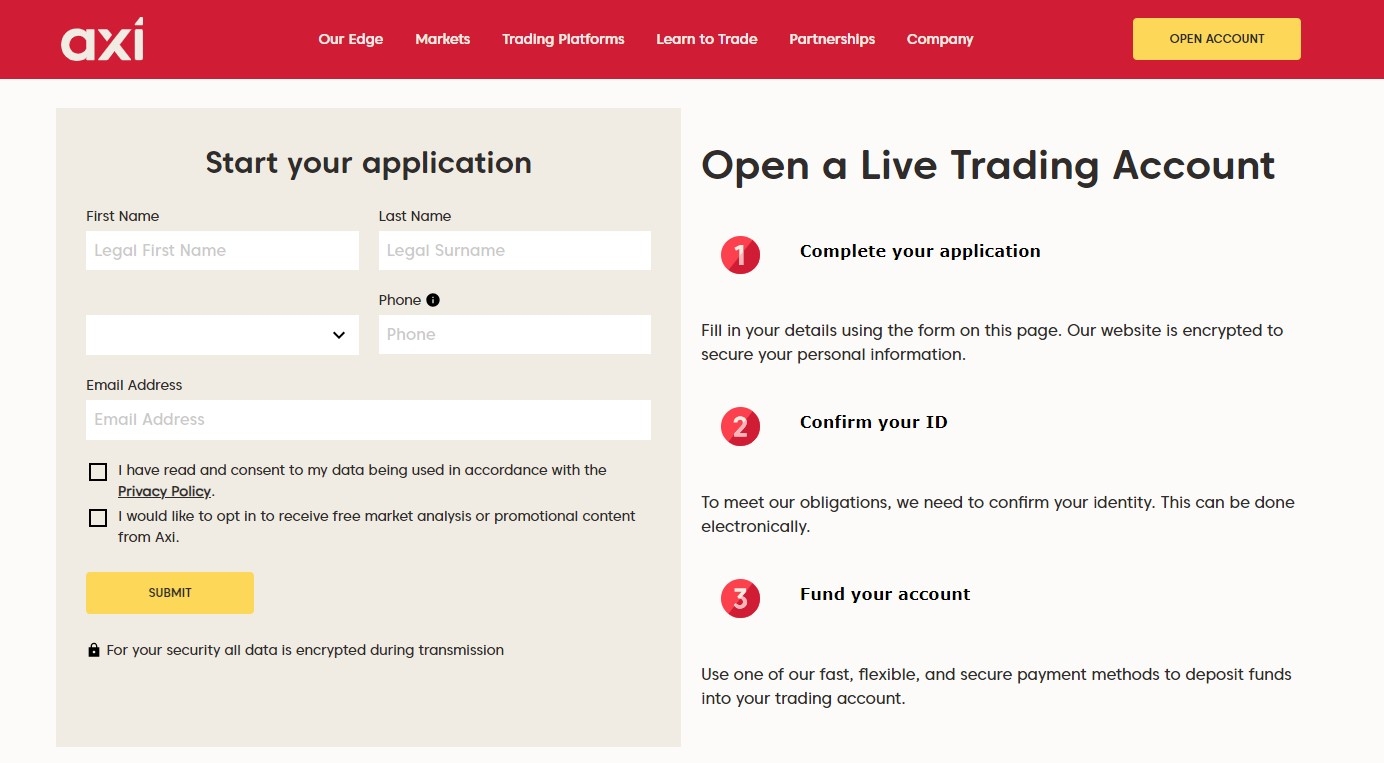

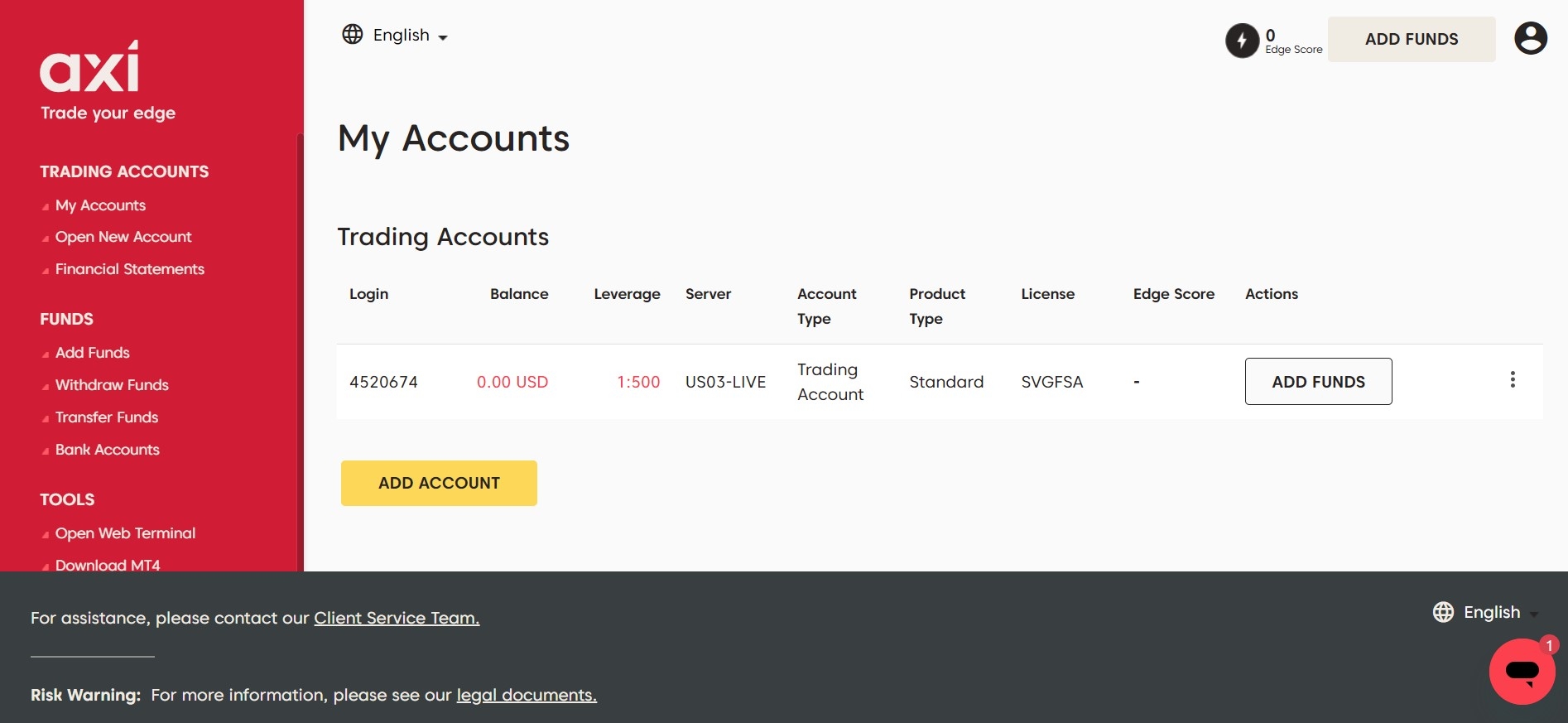

Account Opening

Opening an account with broker Axi is characterized by a high degree of convenience and transparency. Stages such as registration, choosing the type of account, filling in personal details, and verification are structured and easily manageable, even for novice traders. Verification may take some time, but the process is quick and intuitive.

Registration

Opening an account with broker Axi is divided into several stages, which we will consider in order.

First, fill out an online form on the official Axi website. You must provide basic contact information such as name, surname, email address, and phone number.

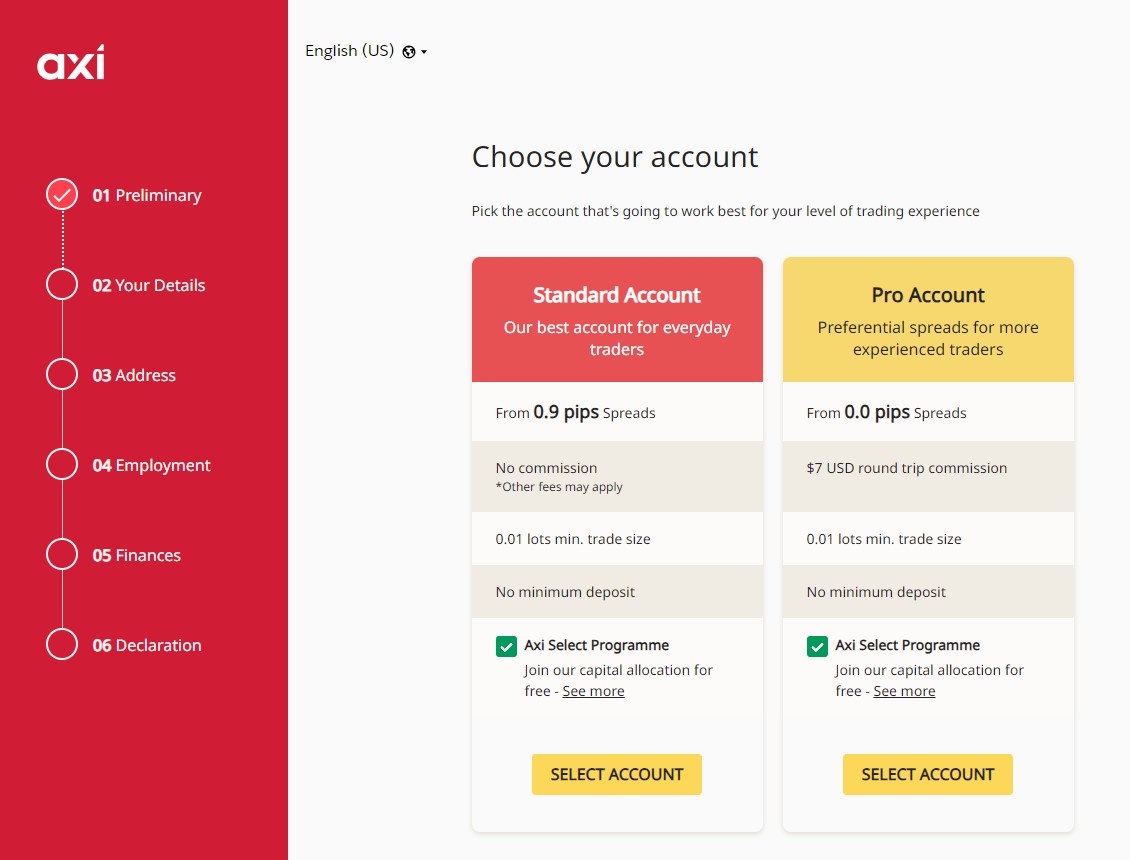

Choosing the Type of Account

At the next stage, you will be offered to choose the type of trading account (Standard or PRO - we will consider them below), the currency of the account (USD, EUR, GBP, etc.), and the size of the leverage (from 1:100 to 1:500).

Filling in Personal Data

You must provide detailed information about yourself, including date and country of birth, residential address, nationality, occupation, financial situation (annual income, asset value, etc.), and trading experience (number of years in the market, previous results, etc.).

Verification

To verify your Axi account, you must provide copies of documents such as a passport or driver's license. Verification may take some time; your account will be activated once completed.

Application for Account Opening

After successful verification, you can apply for a trading account opening. This process is usually quick, and after the account is opened, you can make your first deposit and start trading.

Opening an account with Axi broker is designed for maximum convenience for clients and should not cause difficulties even for newcomers to the Forex market.

Minimum Deposit

The minimum deposit amount for each deposit method at the broker is detailed in the "Account Funding and Withdrawal" section, which lists the minimum deposit amounts for each available payment method.

Your account balance must be sufficient to cover the required margins of your trades. This is a necessary aspect of risk management and maintaining stable trading capital.

The broker-recommended amount for account funding is at least 200 US dollars. Such a deposit size allows for proper flexibility in position management and can serve as an optimal starting capital for most traders.

Account Types

Axi offers a variety of trading account types, from standard accounts ideally suited for beginner traders to professional accounts for experienced traders, as well as specialized accounts, such as Islamic accounts and opportunities for copy trading and MAM/PAMM accounts. However, it should be noted that the absence of fixed spread and cent accounts could further enhance the flexibility and diversity of the services offered. This variety provides a wide choice for traders with different experiences and needs. Still, a small gap in the account offerings slightly limits the full potential for specific categories of traders.

Trading Accounts

Broker Axi presents several trading accounts designed for different categories of traders to meet their trading needs and preferences.

| Standard | Pro | Elite | |

|---|---|---|---|

| Account Currency | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | AUD, EUR, GBP, USD | |

| Minimum Deposit | 1 $ | 25 000 $ | |

| Trading Platforms | MetaTrader 4 | ||

| Spread | floatingfrom 0.9 pipsfor EURUSD~ 1.2 pips | floatingfrom 0 pipsfor EURUSD~ 0.2 pips | |

| Commission per Trade | per 1 lot~ 3.5 $ | per 1 lot~ 1.75 $ | |

| Trading Assets | ForexIndicesStocksCryptocurrencyPrecious MetalsEnergy CarriersSoft Commodities | ||

| Opened Positions | — | ||

| Leverage | 1:1-1:500 | ||

| Margin Call / Stop Out | 100% / 20% | ||

| Order Execution | STP | ||

| Demo Account | |||

| Islamic Account | |||

| Open AccountRegister | Open AccountRegister | Open AccountRegister | |

Standard. This account type is suitable for most traders, especially beginners. The standard account offers comfortable trading conditions with access to all major trading instruments.

Pro and Elite. These trading accounts are intended for experienced traders and professionals looking for more favorable trading conditions with lower spreads and faster order execution.

The choice of account type depends on the trader's experience, preferences, and financial capabilities. Thanks to the wide range of accounts offered, every trader can find a suitable option with broker Axi.

Demo Account

Broker Axi offers its clients the opportunity to open a demo account to familiarize themselves with the trading platform and the trading features without risking their funds. The demo account is active for 30 days and is provided with virtual capital of $50,000, allowing traders to test various strategies and tools in practice.

Islamic Account

For traders adhering to Islamic principles, Axi offers a Swap-Free account on which no swaps are charged for carrying over a position to the next day. The other trading conditions on the Islamic account are similar to those on the standard account.

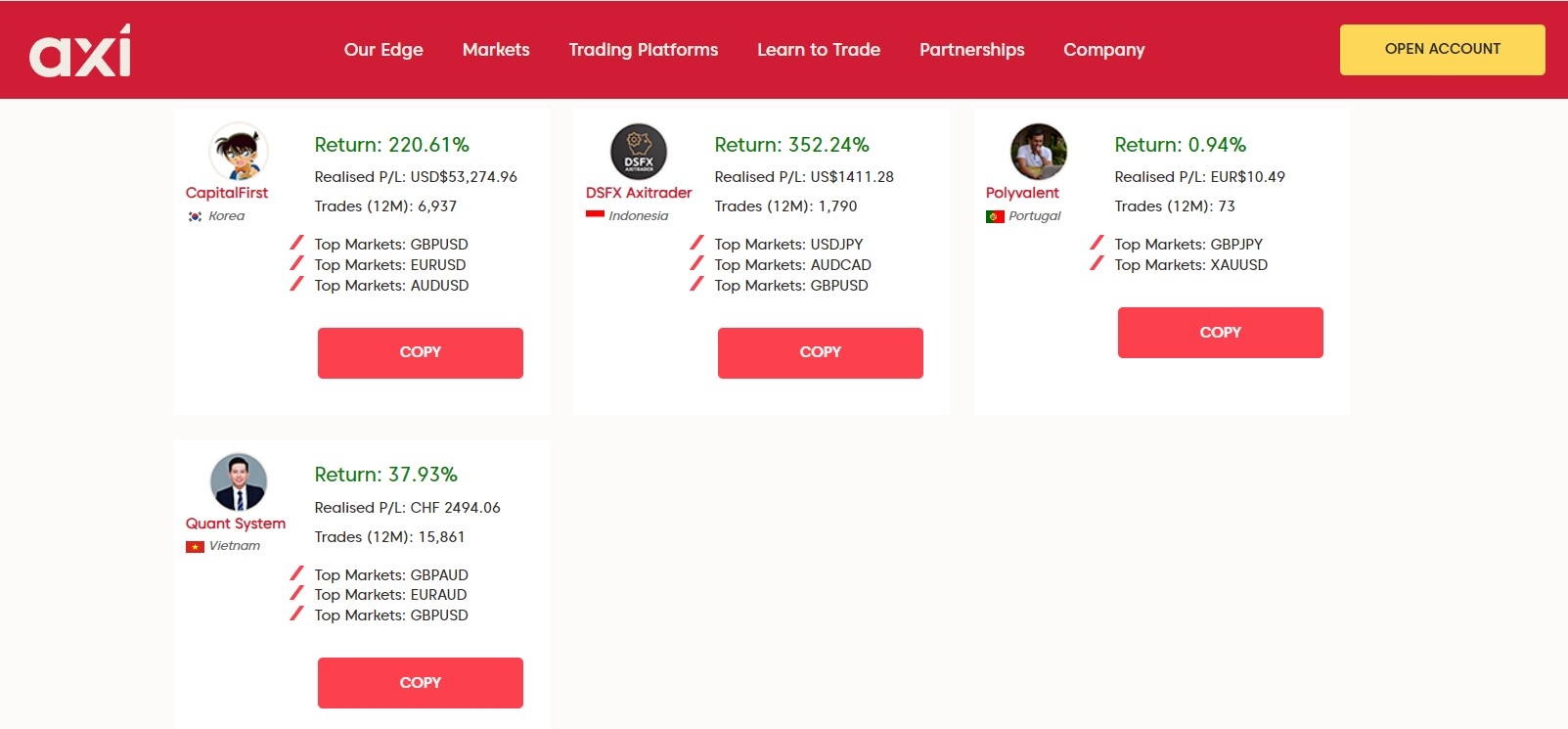

Copy Trading

Forex copy trading is one of the key features offered by the Axi broker. This feature allows even inexperienced traders to replicate the trades of successful and profitable traders worldwide.

How does it work?

- Find a trader to copy. You can select traders based on their performance and strategy.

- Set the trade size and risk level. You determine the copy trading parameters yourself.

- Automatic copy trading. The system automatically copies the trades of the trader you have selected.

Axi regularly receives awards for outstanding trading service, confirmed by Trustpilot reviews.

Copy trading with Axi can be an excellent option for those who want to trade like a professional without delving into the complexities of analysis and independent trade management.

MAM/PAMM accounts

MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts are innovative solutions the broker Axi offers. These accounts allow experienced traders and managers to manage unlimited client accounts using advanced software products and integrated solutions.

MAM accounts

MAM accounts are aimed at professional traders who wish to manage portfolios of various clients.

Benefits of MAM accounts

- Rewards. Set your commissions and manage an unlimited number of accounts.

- Scalability. Integration with MT4 and innovative KeySoft software.

- Growth. Professional support and money management skills development.

- Flexibility. Six different trade allocation methods to meet the needs of various clients.

PAMM accounts

PAMM accounts are designed for managing multiple investor accounts and strategies in real time.

Advantages of PAMM Accounts

- Flexibility. Manage an unlimited number of accounts and set their own commissions.

- Security. Advanced money management system and detailed performance monitoring.

- Rewards. Mutually beneficial conditions and fair rewards for all participants.

- Affiliate program. Opportunity to share rewards for attracting investors to managers.

MAM and PAMM accounts with Axi offer a unique opportunity for traders to monetize their skills and expand their capital management capabilities. The platforms provide potent tools and flexibility in managing risks and rewards. By partnering with a reliable and respected broker, managers can focus on their trading, having support and technology for successful interaction with investors.

VPS Hosting

Axi offers its clients a Forex VPS hosting service through third-party providers. This service ensures continuous operation of the trading platform 24/7, eliminating issues with technological failures or connection problems.

VPS Providers on Axi

Axi collaborates with various VPS providers to ensure high-quality services:

- FOREXVPS. Fast trading thanks to SSD drives located in New York, with 24/7 support and a 100% uptime guarantee.

- MetaTrader VPS. Affordable cloud hosting with seven global servers for low-latency connections.

- Commercial Network Services (CNS). Multilingual support and high security with two-factor authentication, starting at $35 monthly.

- BeeksFX VPS. Banking infrastructure for retail traders, including direct fiber optic connections.

Bonus Offers

Axi offers financing up to a $36 monthly payment for ForexVPS to clients who have traded more than 20 lots in a calendar month and other advantageous discounts and offers with various partners.

Commissions

Axi's trading commissions are in line with industry averages. In addition, the inactivity fee is also a common practice among brokers. Thus, Axi's commission structures can be considered acceptable for most traders but do not stand out as particularly advantageous or offer low market rates.

Trading Commissions

Trading commissions include various expenses such as transaction fees, spreads, and swaps.

Transaction Fee

On the Pro account, the main cost is the lot commission, which is $7. This fee is average for the market and is charged for each trade transaction.

Below is the one-way lot commission for the EURUSD pair at different Forex brokers:

| Broker | Olymp TradeUSDT | BinomoCFD | AxiPro |

|---|---|---|---|

| Commission per lot | $8 | $2 | $3.5 |

Spreads and Swaps

The main expenses on the Standard account are spreads and swaps. These costs are also average for the market and vary depending on trading conditions.

Below is a table of the average spread and swaps for major currency pairs on the standard Axi account.

| Asset | Average spread | Swap long | Swap short |

|---|---|---|---|

| AUDUSD | 1.4 pips | -3.64 pips | 0.91 pips |

| EURUSD | 1.2 pips | -7.00 pips | 2.98 pips |

| GBPUSD | 1.2 pips | -2.50 pips | 0.40 pips |

| NZDUSD | 1.6 pips | -0.65 pips | -0.43 pips |

| USDCAD | 1.5 pips | 0.50 pips | -2.50 pips |

| USDCHF | 1.4 pips | 6.50 pips | -10.50 pips |

| USDJPY | 1.3 pips | 13.80 pips | -23.00 pips |

Account Inactivity Fee

It should be noted that Axi charges an inactivity fee for trading accounts. If there is no activity on the trading account for 12 months, the following fee is charged (as shown in the table below).

Account Currency | Inactivity Fee |

AUD | 10 |

CAD | 10 |

CHF | 10 |

EUR | 10 |

GBP | 10 |

HKD | 80 |

JPY | 1000 |

NZD | 10 |

PLN | 40 |

SGD | 10 |

USD | 10 |

Deposit and Withdrawal

Broker Axi offers clients various methods for depositing and withdrawing funds to ensure convenience and flexibility in financial transactions.

Account Deposit Methods

| Payment System | Currencies | Deposit Fee | Operation Limit |

|---|---|---|---|

0% | from 5 AUD | ||

0% | from 5 USD | ||

0% | from 5 USD | ||

0% | from 5 USD | ||

0% | — | ||

0% | from 50 USD | ||

0% | — | ||

0% | — | ||

0% | from 5 AUDfrom 5 NZD | ||

0% | — | ||

0% | — | ||

0% | from 5 USD |

| Cryptocurrency | Blockchain | Deposit Fee | Operation Limit |

|---|---|---|---|

| BTC | 0% | from 5 USD |

Withdrawal Methods

| Payment System | Currencies | Withdrawal Fee | Operation Limit |

|---|---|---|---|

0% | from 5 AUD | ||

0% limitscommission limits | from 5 USD | ||

0% | from 5 USD | ||

0% limitscommission limits | from 5 USD | ||

0% | — | ||

0% | from 50 USD | ||

0% limitscommission limits | — | ||

0% | — | ||

0% limitscommission limits | from 5 AUDfrom 5 NZD | ||

0% | — | ||

0% | — | ||

0% limitscommission limits | — |

| Cryptocurrency | Blockchain | Withdrawal Fee | Operation Limit |

|---|---|---|---|

| BTC | 0% | from 5 USD |

Broker Axi generally does not charge deposits or withdrawal fees. However, payment systems or banks may impose fees.

All withdrawal requests are processed within 1-2 business days.

Markets and Products

Broker Axi offers a wide selection of trading assets, allowing its clients to diversify their investments and choose the most suitable instruments.

Which markets are available?

| Broker | Olymp Trade | Axi | Binomo |

|---|---|---|---|

| Forex | 28 | 69 | 28 |

| Precious Metals | 2 | 8 | 2 |

| Energy Carriers | 1 | 5 | 1 |

| Indices | 11 | 31 | 5 |

| Stocks | 33 | 144 | 28 |

| ETF | 6 | — | — |

| Cryptocurrency | 19 | 35 | 6 |

| Soft Commodities | — | 3 | — |

Trading conditions for each asset can vary depending on the trader's account type and the current market situation. Broker Axi strives to provide its clients with favorable conditions, including low spreads, commissions, and fast order execution.

Before starting trading with broker Axi, it is recommended that you familiarize yourself with the trading conditions offered for each asset on the company's official website or in your account. It is also worth considering that trading various assets is associated with different levels of risk, and traders should choose instruments that match their investment profile and trading strategy.

Leverage

Leverage may differ for different types of instruments.

| Trading Instrument | Max. Leverage for Retail Traders |

|---|---|

| Forex | 1:500 |

| Precious Metals | 1:100 |

| Energy Carriers | 1:100 |

| Soft Commodities | 1:33 |

| Indices | 1:200 |

| Stocks | 1:33 |

| Cryptocurrency | 1:200 |

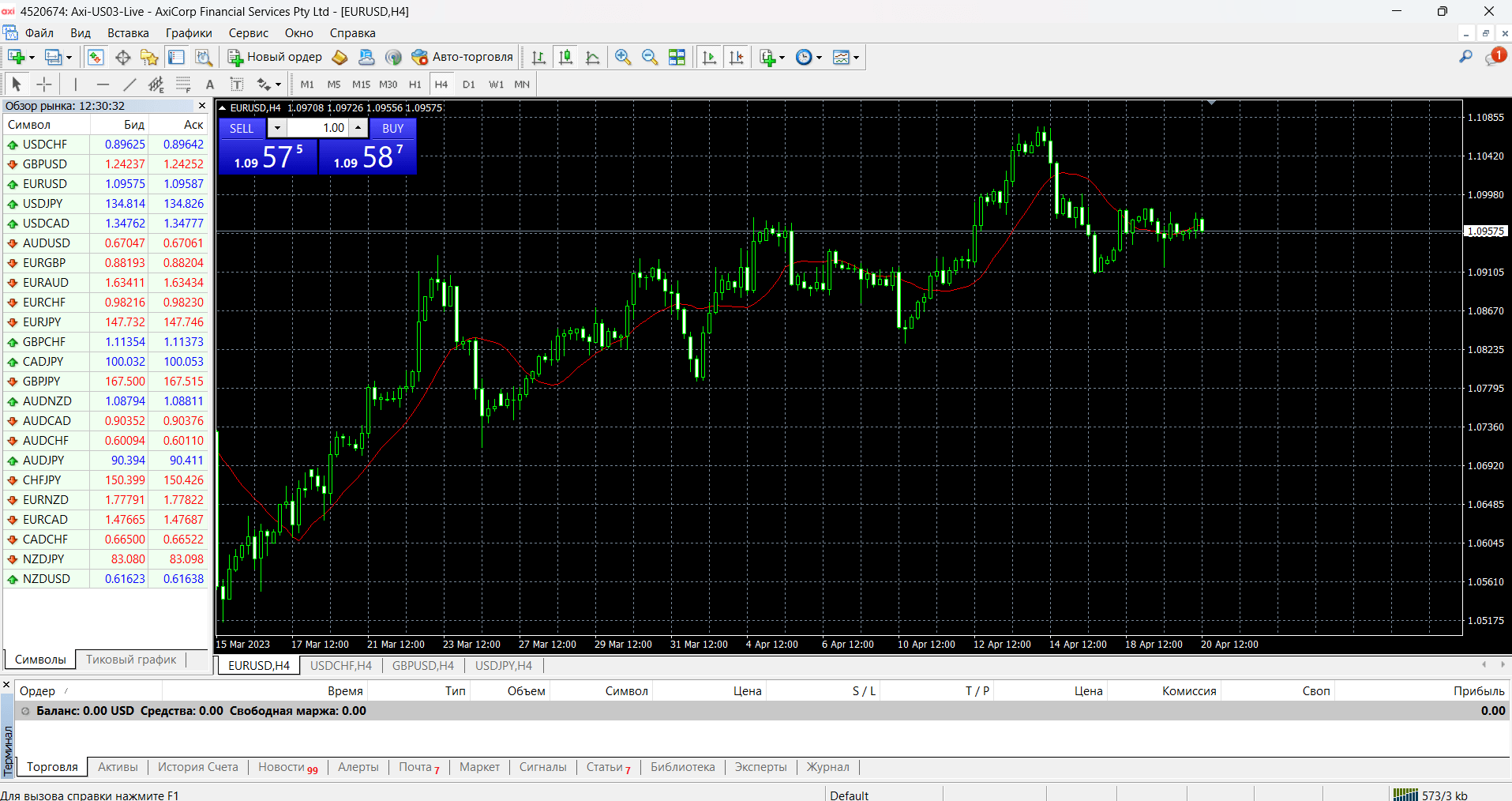

Trading Platforms

Broker Axi offers clients the MetaTrader 4 (MT4) trading platform for executing trades. MT4 is one of the most popular and widely used trading platforms in the Forex market. It offers many features, such as flexible chart settings, technical analysis, automated trading with advisors, etc.

However, it should be noted that some traders may perceive offering only one trading platform as a limitation of broker Axi. While MT4 is a powerful tool suitable for most traders, some prefer using other platforms such as MetaTrader 5 (MT5), cTrader, or various web platforms and mobile applications to manage their investments.

Overall, if you are comfortable working with the MT4 platform and do not require additional features provided by other platforms, the Axi broker may be a good choice. However, for those looking for more diversity in trading platforms, it is worth considering other brokers that offer a more comprehensive selection of trading instruments and platforms.

Analytics

Axi offers a pretty extensive set of market analysis tools. However, it is essential to note that the provided set of tools noticeably lacks in-depth analytical research and expert opinions from the broker's analysts, which may be a drawback for some traders seeking a more comprehensive analysis.

Analytical Tools

Broker Axi provides its clients with several additional trading tools and services that can help improve the trading experience and increase the efficiency of trading strategies. Here are some of the tools offered by Axi:

- Economic Calendar. Tracking all critical events, news, and market indicators using a convenient calendar.

- Holiday Calendar. Calendar of international banking and public holidays that affect Forex and CFD trading.

- Dividend Forecasts. Forecast of upcoming dividend adjustments for Cash CFD indices on the MT4 platform.

- Margin Calculator. A calculator for determining the required margin when opening a trading position.

- Take-Profit and Stop-Loss Calculator. A calculator for estimating the potential profit or loss of trading positions.

- Pip Calculator. A calculator for effective risk management in currency market trading.

- Currency Converter. A tool for converting currency using current exchange rates.

Overall, the tools offered by broker Axi significantly facilitate the trading process, provide access to advanced technologies, and help traders make more informed trading decisions.

Education

Broker Axi offers a comprehensive set of educational materials that will help traders improve their skills and knowledge about trading in the financial markets. However, the broker's platform lacks more personalized education—courses or coaching.

What educational materials are available?

Educational videos. Axi provides a series of video tutorials covering various topics, such as the basics of Forex, technical and fundamental analysis, trading strategies, and the use of trading platforms. These videos will help novice traders master the basics of trading and experienced traders to deepen their knowledge.

Seminars and webinars. Axi regularly conducts seminars and webinars where experienced professionals share their knowledge and experience on various aspects of trading. Such events provide interaction with experts and other traders and discussion of current topics and strategies.

Blog. The Axi blog publishes articles, news, and analytics that will help traders stay abreast of the latest trends in the financial markets, improve their trading strategy, and deepen their knowledge in trading.

E-books. Axi offers e-books on various topics related to trading in the financial markets. These books contain detailed information about trading strategies, analysis, and the psychology of trading and can be a valuable source of information for traders at any level of experience.

The educational materials provided by broker Axi are valuable for traders looking to develop their skills and increase their effectiveness in the financial markets. They allow traders to study trading at a convenient pace and format and receive up-to-date information and analytics from experienced traders.

Customer Support

The technical support of broker Axi stands out for its variety of communication channels and commitment to promptness. Still, inconsistency in service quality and response to severe issues is reflected in mixed customer reviews.

How to contact support?

Axi broker's technical support operates to provide high-quality and prompt solutions to issues and problems that arise for clients. The support team is available 24/5, following the schedule of the international forex market. Clients can contact Axi's technical support through various channels:

Email. If you have questions or problems related to account operations or trading, you can send them to service@axi.com. The technical support specialists will respond to your inquiry as soon as possible.

WhatsApp. Axi offers the option to contact technical support through WhatsApp's popular messaging app. This is a convenient way to get a quick response to your questions without leaving the app.

Toll-free phone call. Axi provides phone numbers for toll-free calls in different regions, allowing clients to receive prompt assistance over the phone without additional costs.

Online chat. The broker's website chat helps you contact technical support quickly.

Axi's technical support cares about its clients, offering various ways of communication and prompt problem resolution. This ensures a comfortable and reliable interaction with the broker for all traders.

Reviews of the broker's support

Axi's technical support has mixed client reviews, reflecting various experiences dealing with the support team.

Positive reviews highlight prompt and professional service, a friendly attitude toward beginners, and a willingness to solve emerging problems. These characteristics contribute to creating a favorable impression of the company and help strengthen trust in the broker.

However, negative reviews point to serious systemic issues, slow and unprofessional responses from technical support, and difficulties with accessing accounts and transitioning between different types of accounts. Some clients have been disappointed with Axi due to service problems and a lack of proper communication.

Thus, Axi's technical support has its merits in accessibility and attentiveness to specific clients. Still, it also requires improvement in response to severe issues and overall consistency of service quality.

Conclusion

Axi provides reliable and secure services in the Forex market. Thanks to regulation, extensive educational materials, and various trading tools, Axi has become an attractive choice for many traders.

However, it is crucial to consider the broker's disadvantages, such as limited choice of trading platforms, unstable quality of support, and inactivity fees. Based on this, Axi may be particularly suitable for beginners and intermediate traders looking for simple and intuitive trading tools and those who want to improve their skills and knowledge with educational materials.

Experienced traders who prefer to use other trading platforms besides MT4 may find Axi less suitable for their needs. Nevertheless, the company continues to offer stable services and competitive conditions, making it an attractive option for many traders in the Forex market.

FAQ

Is Axi legit?

Yes, Axi is a legitimate Forex broker, regulated by several authoritative bodies worldwide such as FCA in the UK and ASIC in Australia.

Which country is Axi from?

Axi is originally from Australia and maintains its headquarters there.

Is Axi an ECN broker?

No, Axi is not an ECN broker. Instead, it operates as an STP (Straight Through Processing) broker, which means orders are passed directly to liquidity providers without any dealer intervention.

How does Axi make money?

Axi earns money primarily through spreads and commissions on trades executed by its clients.

Is Axi good for beginners?

Yes, Axi is considered a good choice for beginners due to its user-friendly trading platforms, educational resources, and responsive customer support.

Does Axi offer a demo account?

Yes, Axi offers a demo account that allows new traders to practice trading with virtual funds without any financial risk.

How can I open an account with Axi?

You can open an account with Axi by visiting their website, filling out the registration form, and submitting the necessary identification documents for verification.

How can I delete my Axi account?

To delete your Axi account, you should contact customer support directly. They will guide you through the process and help with any required paperwork.

What is the minimum deposit for Axi?

The minimum deposit for Axi varies depending on the account type but generally starts from $0 for their standard accounts.

What is the maximum leverage on Axi?

The maximum leverage offered by Axi can be as high as 1:500, depending on the trader’s location and account type.

How do I deposit funds in an Axi account?

Funds can be deposited into an Axi account via multiple methods, including bank wire transfers, credit/debit cards, and various e-wallets.

How do I withdraw money from Axi?

Withdrawals from an Axi account can be made using the same methods as deposits. Requests are typically processed within one or two business days.

Does Axi provide VPS?

Yes, Axi provides VPS (Virtual Private Server) services to help traders execute automated trading strategies with reduced latency.

Is Axi suitable for scalping?

Yes, Axi is suitable for scalping as it offers tight spreads and STP account options that are favorable for high-frequency trading.

Is Axi suitable for auto-trading?

Yes, Axi supports auto-trading and is compatible with various automated trading platforms and tools, including MetaTrader 4.

Is Axi suitable for hedging?

Yes, Axi allows hedging, enabling traders to open multiple positions in the same or different directions to manage their risk.

Is Axi suitable for spread betting?

Yes, Axi offers a spread betting account, which is primarily available to traders in the UK. This allows for tax-free trading on a wide range of financial instruments, including Forex and CFDs.